Invested in Wesfarmers Ltd (ASX: WES) shares? Two of the S&P/ASX 200 Index (ASX: XJO) conglomerate's cornerstone retailers have reportedly switched off part of their security systems amid an investigation by Australia's information watchdog.

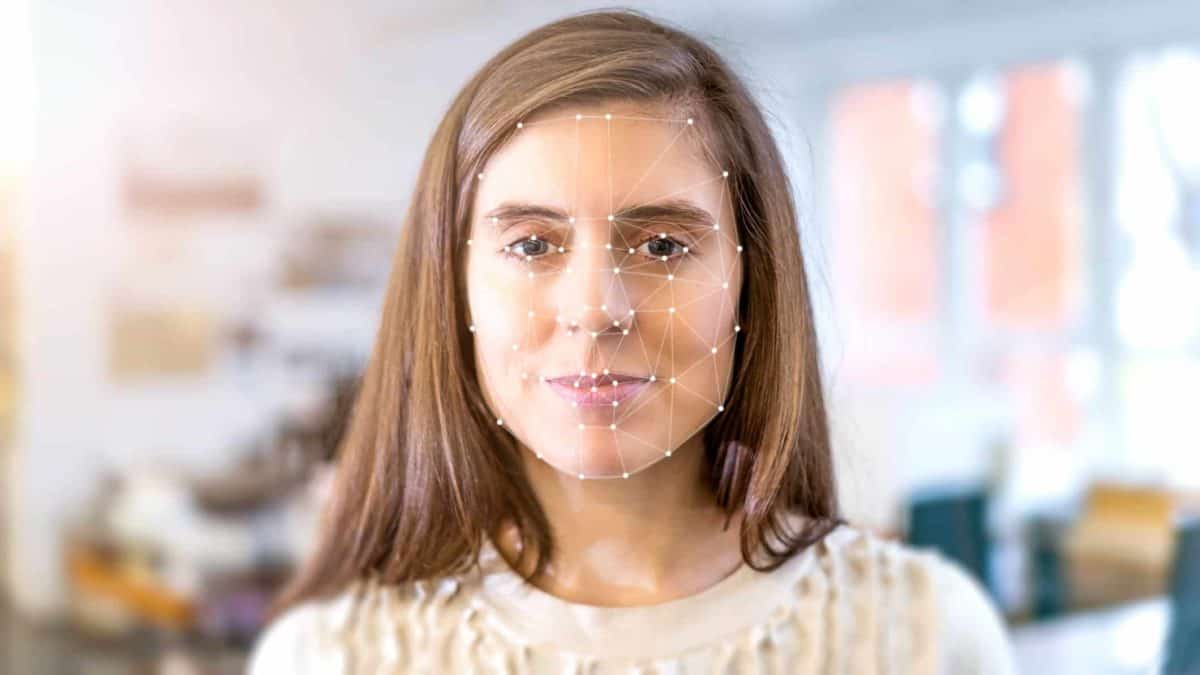

The Office of the Australian Information Commissioner (OAIC) has launched investigations into the retailers' information-handling practices following their implementation of facial recognition technology.

Let's take a closer look at what's going on with Bunnings and Kmart.

Bunnings and Kmart under investigation

Wesfarmers shares have traded relatively flat over the last two months. Meanwhile, two of the company's hallmark retail brands have found themselves in the headlines.

Wesfarmers fans might remember last month's report by Choice questioning the use of facial recognition technology by multiple retailers, including some Kmart and Bunnings stores.

The consumer advocacy group said most customers weren't aware the retailers were using technology capable of capturing and storing unique biometric information such as facial features.

Choice's Kate Bower also noted their collecting of biometric data could constitute a breach of The Privacy Act. Well, the consumer group may not have been the only one concerned about such a breach.

Its findings sparked an investigation by Australia's information watchdog earlier this month.

The investigation has, in turn, pushed Wesfarmers' hallmark retailers to halt their use of the controversial security system, The Guardian reported this week.

Bunnings CEO Simon McDowell has previously said the retailers' use of the facial recognition technology was "consistent with The Privacy Act".

However, managing director Mike Schneider confirmed Bunnings has stopped using the technology in the face of the investigation, adding:

When we have customers berate our team, pull weapons, spit, or throw punches – we ban them from our stores. But a ban isn't effective if it's hard to enforce. Facial recognition gives us a chance to identify when a banned person enters a store so we can support our team to handle the situation before it escalates.

[A]n individual's image is only retained by the system if they are already … banned or associated with crime in our stores. We don't use it for marketing or customer behaviour tracking, and we certainly don't use it identify regular customers who enter our stores.

A Kmart spokesperson said the retailer was previously trialling the technology in a small number of stores for the express purpose of preventing criminal activity.

Kmart believes its use is appropriate and subject to strict controls. It doesn't use the technology to track customer behaviour or for market purposes.

Wesfarmers share price snapshot

The Wesfarmers share price has struggled to gain traction this year.

It has fallen 22% since the start of 2022 and 26% over the last 12 months.

Meanwhile, the ASX 200 has dumped 10% year to date and 8% since this time last year.