This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

If your portfolio is teetering amid a turbulent bear market -- as pretty much everyone's is at the moment -- you need a plan to come out ahead, and you need to act on it.

Fruitful investments made today could have the benefit of a very long run-up once the bear market subsides, and mistakes made out of fear could have consequences for a long time, too.

With those consequences in mind, let's look at three quick steps you can take to make the best out of the market as it is right now.

1. Build on your high-confidence positions

The first thing to do when the market gets rough is to use it as an opportunity to gobble up shares of companies in your portfolio you think will continue to appreciate in value for a long time, even if their stock price is falling in the short term.

Think about a business like Pfizer (NYSE: PFE), which has seen its shares fall by 11% so far this year despite widespread successes with hit products like Comirnaty, its coronavirus vaccine, and Paxlovid, its antiviral pill for COVID.

If you have a position in it and the recent drop scares you off from adding more, you're missing out on a sale -- assuming that you actually believe it'll eventually recover.

So, especially for an investment like Pfizer, which is steadily growing its sales and net income, it makes more sense to be buying shares than sitting on the sidelines. The real trick is to keep investing even when high-confidence picks get rocked.

And as long as your investing thesis is still as valid as when you started buying the shares, you'll be getting the biggest discounts when things look like they're crashing the hardest. Just be aware that you might need to wait a few years before your spending starts to pay off with outsized returns.

2. Set up a dividend reinvestment plan

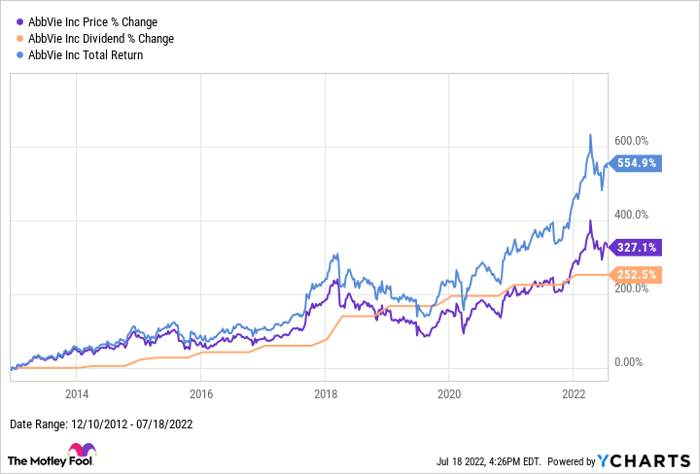

Another great action to take to weather the bear market is to enable a dividend reinvestment plan (DRIP) for your dividend-paying stocks. Take the returns from AbbVie (NYSE: ABBV) over the last 10 years, for example:

As the chart shows, the price returns from AbbVie shares are nowhere near the total return that's possible by retaining and reinvesting each of its quarterly dividend payments. When you reinvest your dividends instead of accepting them in cash and spending them elsewhere, your position compounds in value much faster.

And when share prices dip during a bear market, the stock's dividend yield increases accordingly, meaning that if you aren't reinvesting your dividends at that moment, you're missing out on securing some higher-yield shares for the remaining years of your long hold.

Plus, biopharma companies like AbbVie often have significant cash flows that are enough to keep hiking their dividend even when there's a bear market, recession, or other economic issues.

That means if you don't set your shares to reinvest their dividends now, then by the time the bear market is over, you might have missed out on quite a bit of compounding at a very attractive rate. And it would be a shame to lose out on this bonus that's there for the taking.

3. Talk yourself out of panic selling (or buying)

Perhaps the most important step to take during a bear market or market crash is to take a deep breath and talk yourself out of selling your shares in a panic. (It's also helpful to avoid frantically buying the dip on stocks you aren't fully confident in but seem priced like a bargain.)

Selling your shares locks in whatever losses you've sustained, regardless of whether there is a valid business reason for the underlying company to experience additional headwinds.

In the current market, it's true that there are quite a few economic headwinds making things difficult, but it's also true that buying high and selling low is a losing strategy.

Eventually, the market will recover, and when it does, the stock you're itching to sell could easily come back with a vengeance. Therefore, when you get tempted to pull the plug on some of your investments, you'll regret not stepping back, especially if you don't have a need for the money you invested anytime soon.

When I get tempted to sell due to market chaos, I find that it's often helpful to simply close my browser tab displaying my portfolio and take a walk outside.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.