This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

What happened

Shares in Warren Buffett's Berkshire Hathaway (NYSE: BRK.A) declined by 13.7% in June, underperforming the benchmark S&P 500 index's decline of 8.4%. The place to start when looking at why is by analyzing what's in the Berkshire Hathaway portfolio. So here's a table of all the holdings above 3% in the portfolio as of March 2022.

| Company | Sector | Portfolio Weight |

|---|---|---|

| Apple | Consumer electronics | 42.1% |

| Bank of America | Bank | 11.3% |

| American Express | Financial services | 8% |

| Chevron | Energy | 7% |

| Coca-Cola | Consumer staples | 7% |

| Occidental Petroleum | Energy | 3.6% |

| Kraft Heinz | Consumer staples | 3.5% |

Data source: Berkshire Hathaway SEC filings.

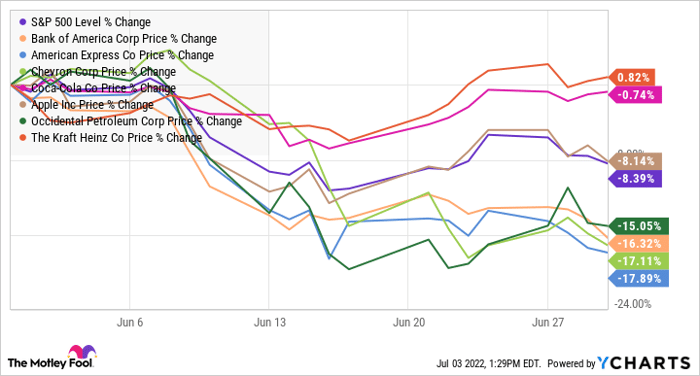

As you can see below, Apple's performance in June was pretty much in line with the market, and the leading consumer staples stocks (Coca-Cola and Kraft Heinz) outperformed the market. However, the finance and energy stocks significantly underperformed. For reference, Berkshire holds a further 7% in banking and finance stocks.

Data by YCharts

The performance in June marks a reversal of fortune because, going into the month, Berkshire Hathaway was up in 2022 with a 5.2% gain compared to a 13.3% decline in the index. In addition, energy and consumer staples led outperformance to the start of June.

So what

The reversal in Berkshire Hathaway's performance reflects the shift in the market's mood more than any fundamental change in the long-term prospects of the companies in the portfolio. Speculators likely bought into the type of stocks seen as benefiting from inflationary trends (energy) and kept buying until the Federal Reserve acted aggressively to combat inflation by hiking rates.

However, as the market anticipated and then digested the Federal Reserve rate hike in the middle of June, it sold off the "inflation plays" as well as the cyclical, banking, and financial stocks. The idea is that rising rates will make spending and investment more expensive, meaning end-market demand will tail off.

Now what

The market will do one thing, and Buffett will do another. Reacting to near-term market movements and trying to trade sentiment and mood changes among investors is rarely a winning strategy over the long term. Indeed, Buffett's success as an investor lies precisely in avoiding this kind of knee-jerk trading. Instead, Buffett tends to favor buying and holding companies for their long-term fundamental earnings power. And while the market is panicking, it's worth noting that Berkshire Hathaway is only down 1% on a year-over-year basis. Something to consider.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.