This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Netflix (NASDAQ: NFLX) stock has been experiencing a miserable run over the past six months. The streaming pioneer thrived in the early stages of the pandemic when folks were staying at home more often and demand for entertainment was surging. Meanwhile, the COVID-19 restrictions meant that the entire industry paused content creation, saving billions in cash for Netflix.

Those ideal conditions have quickly vanished while headwinds are gaining momentum. Netflix went from adding millions of subscribers every quarter to now reporting losses. The stock is down 75% off its highs as a consequence. However, Netflix could be at a tipping point where investors may want to take notice.

Investors fear subscriber losses will continue

In its most recent quarter, which ended on March 31, Netflix noted that it lost 200,000 subscribers from the quarter before. That was its first such quarterly decline in over 10 years. But what made matters worse was that Netflix forecast another loss in the second quarter of 10 times that magnitude. If it comes to fruition, the expected 2 million subscriber loss in Q2 will now make it a trend of subscriber losses rather than a one-off event. That is understandably spooking investors uncertain about how long or deep it will be.

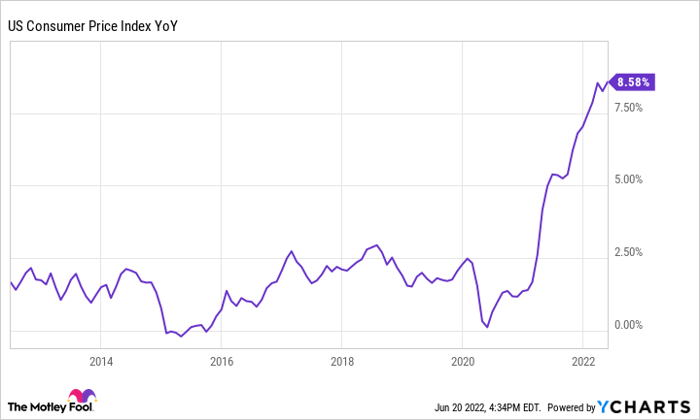

A meaningful part of the stock's decline is due to those fears. Therefore, if Netflix, in its next quarterly update, informs investors that it expects subscriber losses to subside and issues a forecast for millions of new customers in Q3, it could cause the stock to reverse higher. While the current quarter may not hold significant catalysts to boost subscriber growth, the next may be different. Inflation is biting into consumer budgets, forcing them to make the tough decisions on where to save money because they are paying more for necessities like food and gas.

US Consumer Price Index YoY data by YCharts

At less than $20 per month, Netflix is arguably an affordable entertainment option for families worldwide. In contrast, a visit to the movie theater could cost five times as much for a family of four (including concessions). And a concert, theme park, or sporting event could be multiples higher than even that amount. Of course, there are cheaper streaming service options, but Netflix has announced its own lower-priced, ad-supported tier that could be available this year.

Macroeconomic conditions have been a significant headwind for Netflix in 2022; those look like they are at their nadir. The turnaround might be a tipping point that could send Netflix's stock higher.

Netflix's cheap valuation could propel it higher

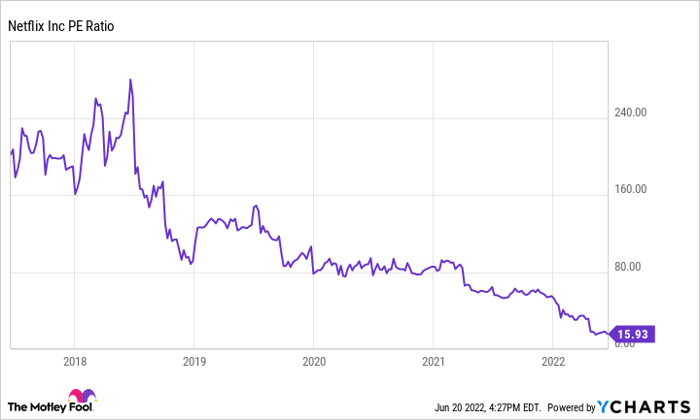

NFLX PE Ratio data by YCharts

Netflix is trading at a price-to-earnings of 15.9, its lowest in the last five years. The cheap valuation suggests that once investors observe the turnaround in subscriber losses, the stock could jump in response. The longer-run trend is on Netflix's side with consumers canceling traditional cable subscriptions and streaming their content instead.

The short-term headwinds are bound to subside; it appears a question of "when not if." Rather than trying to time the bottom, investors may want to start adding a position in Netflix stock now.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.