This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

With the Core Consumer Price Index (CPI) rising by 8.6% over the past 12 months, inflation is the word of the year, and many portfolios aren't fully ready for it. Rising costs give way to thinner margins, and growth-stage companies are getting hit by the market's reaction particularly hard.

But you aren't powerless in the face of inflation. Understanding how to hunt down inflation-resistant stocks is half the battle, and they're more common than you might think. Let's take a look at three things to look for when you're scouting for the stocks that'll anchor your portfolio's value during the ongoing inflationary storm.

1. How necessary are the products for potential buyers?

The first thing to look for when you're evaluating a stock's ability to hold value through a patch of inflation is whether its products are something that buyers will be able to do without. For instance, CVS Health (NYSE: CVS) sells a huge number of consumer health items that people need no matter their cost, like contact lens fluid and antacids. That means even if prices rise, consumers will still be buying the products, though they may look for substitutes or cheaper alternatives than what CVS might carry.

Another good example of highly necessary products are many of the life-saving prescription medicines made by Pfizer (NYSE: PFE). In Pfizer's case, its customers are pharmacies like CVS as well as healthcare systems, which in the U.S. are counterparties to insurers.

If Pfizer hikes the price of a drug that it sells to hospitals to keep pace with inflation, the hospitals can then pass the additional cost on to insurers. What this means is that the company's primary customers aren't about to balk at a higher price point for the medicines they need to treat patients, so its base of revenue is unlikely to budge by much.

2. Steady cash flows over time

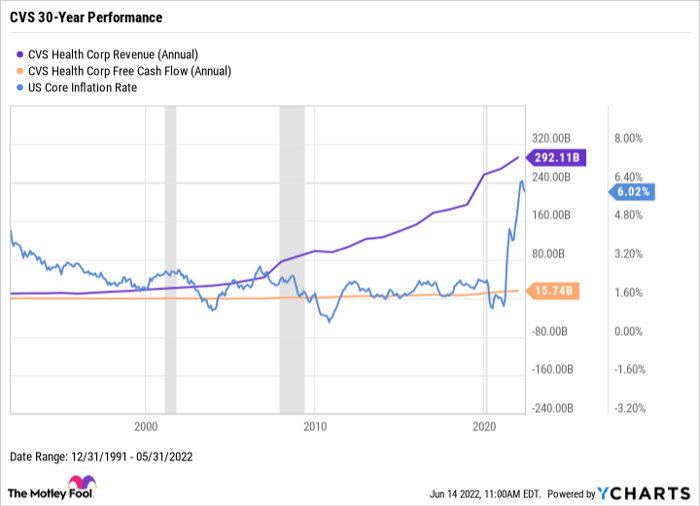

Stable businesses can weather different economic environments without significant negative impacts to their cash flows. The best way to find a business with steady cash flows is to look at a company with a highly needed group of products and examine its financial performance over a very long period. Take a look at this chart.

CVS Revenue (Annual) data by YCharts

As you can see, CVS' revenue and free cash flow (FCF) smoothly and slowly increased over the last 30 years. There were a trio of recessions in that period, as indicated by the shading on the chart, and plenty of different economic forces (including inflation) affecting it over time -- but none of that stopped the company's upward march for very long. And all that needed to happen was executing on its business model of building out retail pharmacies and then selling consumer health goods to people who go there to get their prescriptions filled.

3. Having a clever plan to deal with inflation

Companies that have an inflation strategy are better equipped to deal with rising input prices and potential softening of demand than those that don't. For many, the strategy may simply be to "increase prices as much as our customers will tolerate," but that could easily end up destroying demand and causing revenue to fall.

One innovative strategy used by Costco (NASDAQ: COST) is to keep certain prices, like the price of its hot dog and soda combo in its food court, at a fixed level that doesn't change in response to inflation, but to let other prices float as needed. Since the 1980s, the combo costs only $1.50, and there are no plans to change that amount.

While it's true that this means the business will have an ever-poorer margin on the combo, which still faces rising supplier costs, it helps to mitigate the sticker shock that customers experience when buying something familiar. And when competitors are unashamedly hiking prices by significant amounts, it makes those that don't hike 100% of their prices look all the better -- even if some products do end up being marked up.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.