This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Amazon (NASDAQ: AMZN) has had a volatile few years since the pandemic's onset. It did an excellent job fulfilling the surge in demand for customer orders when folks were avoiding shopping in person. As economies reopen, sales growth is slowing down but remaining at high levels. Between all of that, founder Jeff Bezos stepped down from his role as chief executive officer of his founded company.

And now, Amazon's stock has fallen along with the broader market, creating a favorable opportunity to buy. Let's look at three reasons investors should buy Amazon stock and one reason to be cautious.

1. Its cloud computing business is thriving

Amazon's web services segment (AWS), which provides cloud computing services to enterprises worldwide, grows faster than the business overall. In its most recent quarter, which ended March 31, AWS reported revenue of $18.4 billion. That was up by 37% from the same quarter in the prior year. Increasingly, businesses are choosing Amazon for their computing infrastructure needs. With Amazon's cloud services, companies can turn what used to be a considerable up-front capital expense into a monthly expenditure.

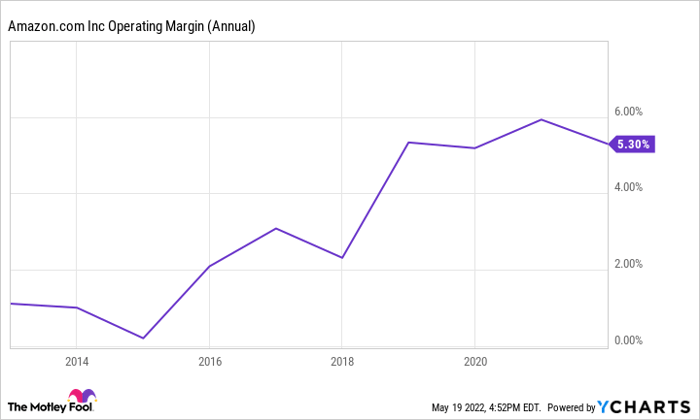

Fortunately for Amazon, AWS also delivers healthy profit margins. Indeed, in the same quarter mentioned above, AWS earned $6.5 billion in operating income on revenue of $18.4 billion. To put that into perspective, Amazon has not reported an operating profit margin of over 6% overall in the last decade. Without the AWS segment, Amazon would be losing money.

AMZN Operating Margin (Annual) data by YCharts.

Amazon has the leading market share in the cloud industry, which is expected to grow nicely from the estimated $400 billion in annual sales it achieved in 2021.

2. It's developing a robust advertising business

Another powerful reason to own Amazon stock is that it's built a robust advertising business. Amazon has increased ad sales by more than 25% in its past six quarters. In Q1, ad sales totaled $7.9 billion. Like the AWS segment, advertising is a lucrative business. Besides the initial costs to set up the capability, there is little expense associated with incremental ad sales.

Amazon boasts over 200 million Prime members. These folks have a payment method on file and access to fast and free delivery provided by Amazon. They are also one click away from purchasing a product. There is arguably no other advertising real estate that is so close in proximity to consumer purchase. It's not surprising that marketers would want the opportunity to influence individuals browsing Amazon's app and website.

3. The stock is cheaper than it has been in years

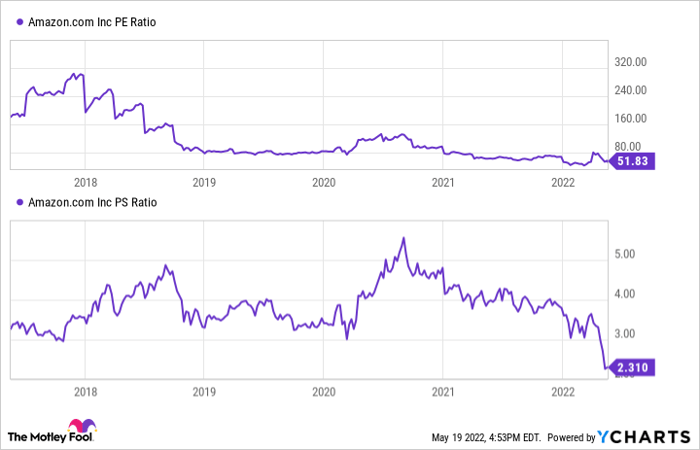

AMZN PE Ratio data by YCharts.

Making the case to buy Amazon more compelling, the stock is cheaper than in years. Amazon's price-to-sales ratio of 2.3 and price-to-earnings multiple of 52 is near their lows of the past five years. The company has been caught up in the broad market sell-off, and its stock is down considerably off its highs.

Reason to hesitate: e-commerce sales growth is slowing

The one reason to hesitate about Amazon is the near-term headwinds facing its online sales. Consumers boosted spending online at the pandemic's onset to avoid shopping in person. Now that billions of folks have gotten vaccinated against COVID-19 and brick and mortar stores are reopening, people feel better about leaving their homes. That's creating a headwind for Amazon, which saw online sales fall by 3% year over year in its quarter ended in March.

To be sure, it's a significant slowdown from the 40% growth the business experienced in Q4 2020 and Q1 2021. The trend of falling sales could continue if the threat of COVID-19 continues to fade in consumers' minds. Yet ultimately, investors should not allow these risks to stop them from buying an otherwise excellent company at a bargain price.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.