This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Netflix (NASDAQ: NFLX) is having a rough first few months in 2022. Due to multiple factors, including rising competition and headwinds from the economy's reopening, the stock is down over 40%.

The company will be reporting first-quarter earnings on April 19, and that event could create a buying opportunity for long-term investors in the coming weeks. Let's look at why that might be the case.

Netflix is way ahead of the competition

Usually, Netflix adds roughly 8.4 million subscribers in the first quarter, including cancellations. At least, that's been the average in the first quarter, going back to 2017. Management has set the bar much lower this year. Netflix guided investors to look for additions of just 2.5 million in Q1 of this year, which is 5.9 million below its historical average. The lowered expectations make it more likely that Netflix will surpass those estimates. However, if it reports less than the 2.5 million figure, that could trigger further selling of Netflix stock.

That scenario would be a buying opportunity for long-term investors, barring any commentary from management that suggests there are serious problems. Don't get me wrong -- slowing subscriber growth is not something to ignore. That said, the stock has arguably already paid the price, falling 42% so far in 2022. Furthermore, the coronavirus pandemic may have boosted subscriber growth during the initial lockdown phases, but that likely brought forward customers who may not have signed up until 2022 or 2023. Understandably, growth would slow after a massive surge.

That brings me to the fear of rising competition. Netflix has had more than a decade's head start on most of these new entrants. It already boasts 222 million paying subscribers, while The Walt Disney Company is the only other one that claims over 100 million. Moreover, Netflix's 222 million subscribers generated nearly $30 billion in revenue in 2021, and it's already on pace for more in 2022. The massive scale gives Netflix a difficult-to-match content budget. In 2021, it spent $17.7 billion on content, $6 billion more than in 2020.

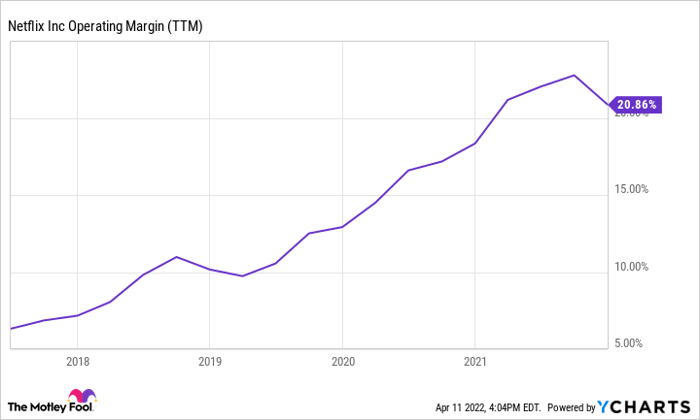

NFLX Operating Margin (TTM) data by YCharts

Perhaps more importantly, even though Netflix is boosting spending on content, it is doing so responsibly. The restraint could be demonstrated by observing the rise in Netflix's operating profit margin in the last five years. The company is balancing a rising content budget with an intent to increase profitability. Indeed, management's long-term outlook has stated a goal of steadily increasing the operating profit margin each year.

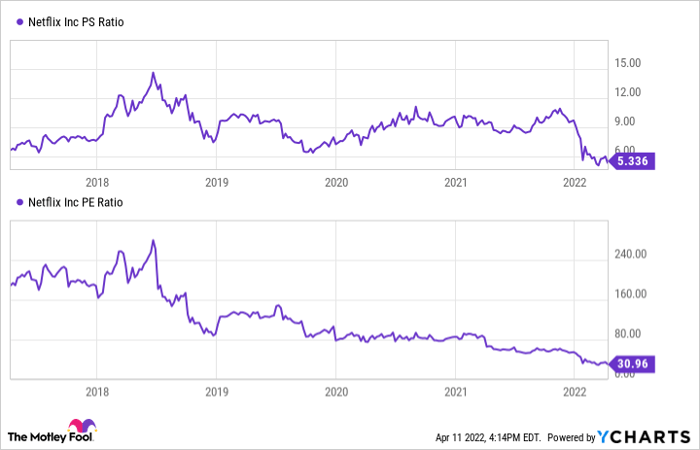

The sell-off has Netflix trading at bargain prices

Netflix is trading at price-to-sales and price-to-earnings ratios of 5.3 and 31, respectively. Those are near the lowest valuations it has sold for in the last five years. As I mentioned earlier, the company is paying the price for slowing growth and concerns over competition.

NFLX PS Ratio data by YCharts

However, Netflix has a powerful secular tailwind at its back from consumers canceling traditional cable subscriptions and moving to streaming services. Additionally, a rise in the quantity and quality of mobile devices means people have more opportunities to stream content.

There will undoubtedly be volatility in the near term, especially surrounding the company's earnings report on April 19. Still, in the long run, Netflix could steadily increase subscribers and profits for several years -- and it could be an excellent stock to buy in the coming weeks.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.