ASX big bank shares were finding good support today, especially after a leading broker suggested that some of them could be on the verge of launching more multibillion-dollar share buybacks.

The National Australia Bank Ltd (ASX: NAB) share price and Commonwealth Bank of Australia (ASX: CBA) share price gained in afternoon trade, closing the day 1.57% and 1.3% higher, respectively.

The Australia and New Zealand Banking Group Ltd (ASX: ANZ) share price also finished in the green, up 0.76%.

In comparison, the S&P/ASX 200 Index (ASX: XJO) added 0.5% in Wednesday trade.

NAB, ANZ and CBA shares could get a buyback lift

The outperformance of the NAB, ANZ and CBA share prices may have something to do with Morgan Stanley's latest note on the sector.

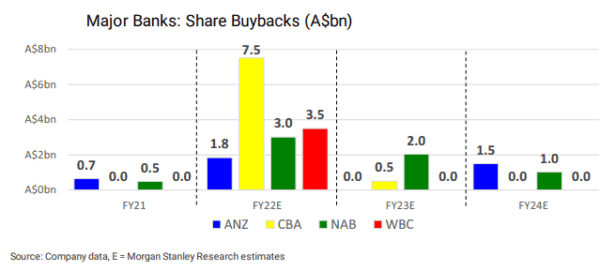

The broker reckons that ANZ and NAB could announce a new share buyback when they release their interim profit results. ANZ has the capacity to buy $1 billion worth of its shares, while NAB could purchase $2 billion.

Excess capital is a nice problem to have

"ANZ and NAB are close to finishing their respective A$1.5bn and A$2.5bn share buybacks, which were announced in 2021," said Morgan Stanley.

"So far, ANZ has bought back ~A$1.46bn and NAB has bought back ~A$2.43bn."

Asset sale to fund new buyback of CBA shares

Meanwhile, CBA could be poised to launch another share buyback as well. Australia's largest bank completed a $6 billion off-market buyback in October last year.

It also announced a $2 billion on-market share buyback at its 1H FY22 results in February. This buyback should commence shortly.

"Beyond this, we don't forecast any more buybacks, but management has stated that it will have 'flexibility to consider further capital management initiatives,'" added Morgan Stanley.

"With this in mind, the proposed sale of a 10% stake in Bank of Hangzhou could support another ~A$2bn buyback."

WBC is the outlier – but maybe not

If the prediction comes to pass, ASX big banks could repurchase around $15.8 billion of their shares in FY22. This could make the current financial year one of the biggest years for bank share buybacks.

Westpac Banking Corp (ASX: WBC) is the only one of the ASX big four that Morgan Stanley doesn't think will launch a new buyback, not after it completed a $3.5 billion buyback just last month.

But the broker did acknowledge that capital releases from the sale of other non-core assets could change that view.

Why share buybacks matter to ASX investors

In case you are wondering why investors should care about such capital initiatives, share buybacks are generally earnings accretive for shareholders.

This is because the bank's profits are shared over a smaller number of shares. All else being equal, the bank's earnings per share (EPS) will increase due to the smaller pool of shares.

EPS drives valuations as price-earnings multiples are based on this metric. Also, dividend payout ratios are measured against EPS. Thus, if the EPS increases and the payout ratio is held constant, shareholders will receive a bigger dividend cheque.