The share price of robotics technology company, FBR Ltd (ASX: FBR) is surging on news of its flagship robot.

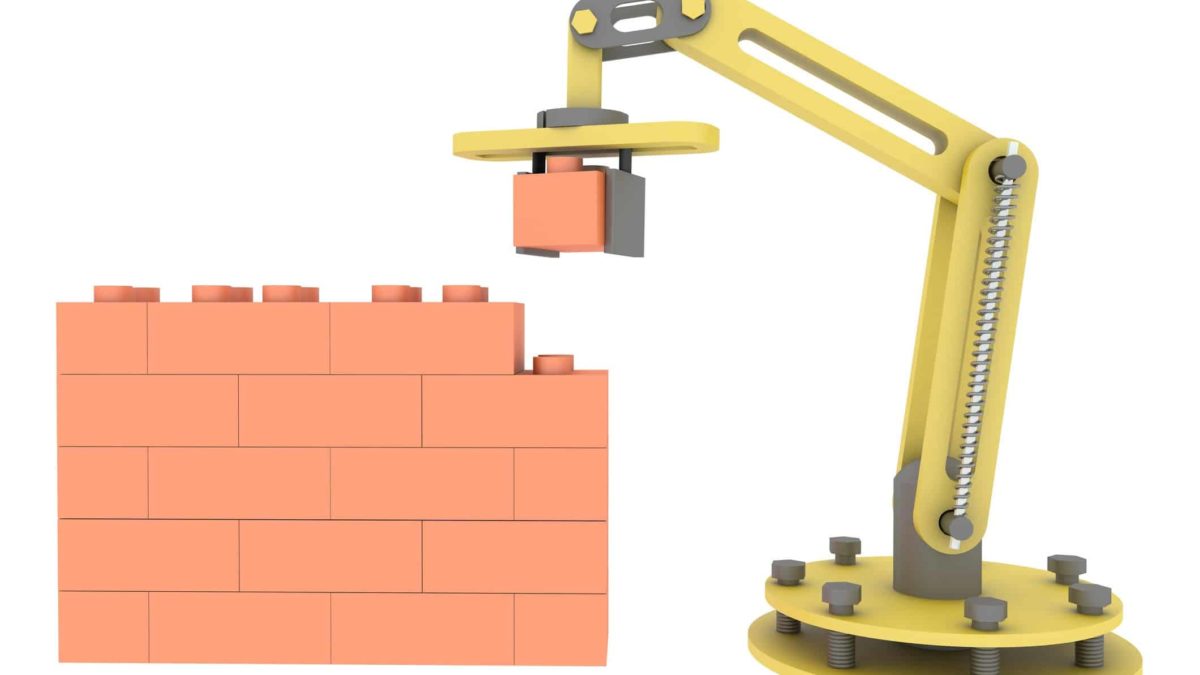

A new generation of the company's bricklaying robot, Hadrian X is set to be industrialised and commercialised under a potentially transformational partnership.

At the time of writing, the FBR share price is 3.8 cents, 8.57% higher than its previous close.

Let's take a closer look at what's piqued the market's interest in the robotics small-cap today.

FBR's stock gains on the future of Hadrian X

The FBR share price is in the green after the company announced a memorandum of understanding with manufacturer and supplier of concrete systems, Liebherr-Mischtechnik.

Liebherr-Mischtechnik is part of the Liebherr International Group – one of the world's largest construction equipment manufacturers.

Together, the companies will be working on bringing the next rendition of Hadrian X to the global construction market.

They will do so in 2 phases. First, FBR, with the help of Liebherr-Mischtechnik, will develop the next generation of the robot.

It will ensure it's tough enough to live its life on job sites while still being cost-effective to manufacture.

Less than 2 years later, the companies will embark on phase 2.

That will see Liebherr-Mischtechnik appointed manufacturer of Hadrian X robots. It will also address intellectual property rights and commercialisation activities.

During the life of the agreement, FBR will be free to manufacture its own Hadrian X prototype robots.

Commenting on the news driving the company's share price today, FBR managing director and CEO, Mike Pivac said:

This memorandum of understanding demonstrates a clear pathway for FBR to achieve scale with the support of an aligned partner who understands the future construction industry landscape and has the technical capability, reputation, and professionalism to deliver 21st century machinery such as the Hadrian X to the world.

FBR share price snapshot

The FBR share price has had a rough start to this year.

It has fallen 11% year to date. It's also 22% lower than it was this time last year.