The Sparc Technologies Ltd (ASX: SPN) share price is jumping today amid an update on the company's green hydrogen project.

The South Australian company's shares are currently swapping hands at $1.22, a 6.55% gain, after trading as high as $1.30 earlier in the session.

Let's delve into what the company revealed today.

Joint venture

Sparc provided an update on its joint venture with Fortescue Metals Group Limited's (ASX: FMG) hydrogen-focused renewable energy subsidiary Fortescue Future Industries (FFI) and the University of Adelaide.

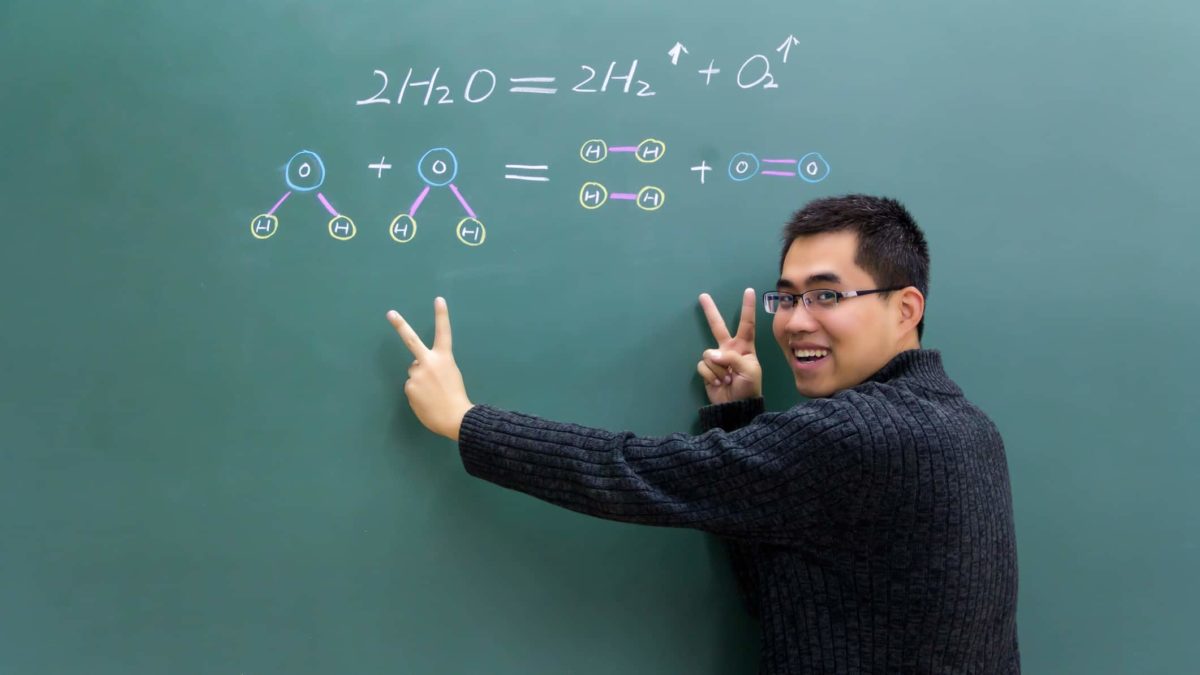

The project aims to produce commercially viable green hydrogen via a process known as photocatalysis. This involves making hydrogen from water using radiation from the sun.

Sparc reported the transaction is complete and all conditions have been met. Fortescue Future Industries has already made a stage 1 payment to Sparc Hydrogen of $1.8 million. In stage 1 of the project, Sparc will hold 52% of the venture while the university will hold 28% and Fortescue 20%.

As my Foolish colleague Brooke reported last week, both Fortescue and Sparc will eventually own 36% of the venture in stage 2 while the University of Adelaide will hold the remaining 28%.

In today's announcement, Sparc said work on the project has commenced and key equipment has been ordered. An initial techno-economic assessment of the technology is also underway.

Management comment

Commenting on the announcement, executive chairman Stephen Hunt said:

It is pleasing to now have satisfied all conditions to complete the transaction and to work with Fortescue Future Industries and University of Adelaide to further progress this exciting project.

Furthermore, the inclusion in the joint venture of world leading green energy company, Fortescue Future Industries, adds enormous value to the joint venture, both in terms of project development, technology and commercialisation capabilities.

Share price snapshot

In the last 12 months, the Sparc Technologies share price has soared 321%. For perspective, the S&P/ASX 200 Index (ASX: XJO) has returned nearly 6% over the past year.

However, year to date, the Sparc share price has dropped 26%, losing more than 27% in the past week alone.

Sparc Technologies has a market capitalisation of about $80 million based on its current share price.