Key points

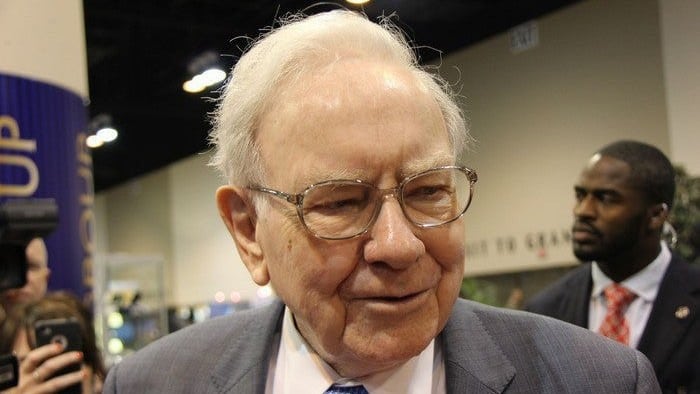

- Warren Buffett runs the giant conglomerate Berkshire Hathaway

- Buffett is well known for his conservative investing style that has given investors decades of compounded returns

- He was one of the few billionaires that made money last month…

Warren Buffett has still got it, it seems. As most of us would be aware, last month was not a kind one for ASX shares. The S&P/ASX 200 Index (ASX: XJO) ended up losing more than 6% last month in what was one of the worst January's ever for ASX shares. The US markets didn't do any better though. Over January, the S&P 500 Index (INDEXSP: .INX) also had a shocker, falling just over 5%. Both markets would have been a lot worse if it wasn't for the uptick we saw over the last couple of trading days.

So with the US markets having a turbulent January, many of the world's richest people also took haircuts to their net wealth over the month just gone. According to the Bloomberg Billionaires Index, nine out of the top ten richest people in the world saw their wealth go backwards over January. That tenth person was none other than Warren Buffett.

Yes, January saw everyone from Elon Must, Mark Zuckerberg and Jeff Bezos to Bill Gates, Larry Page and Steve Ballmer lose a significant chunk of change. According to the Index, it was Tesla Inc (NASDAQ: TSLA) CEO Elon Musk whose wealth took the biggest dive though. Over January, Musk saw his fortune shrink by a mind-boggling US$50 billion, leaving him with a fortune 'only' worth US$220 billion by the month's end.

Bezos saw a US$23.4 billion haircut, while Zuckerberg took a US$12.7 billion hit.

How did Warren Buffett manage to grow his fortune over January?

But Warren Buffett managed to grow his net worth by US$4.46 billion to a total of US$113 billion over the month.

So how did the 'Oracle of Omaha' manage to increase his net worth so decisively? Especially when most investors, including his nine compatriots in the top ten list, lost money last month?

Well, we don't have to look too far. The vast majority of Mr Buffett's fortune is tied up in shares of the company he runs, Berkshire Hathaway Inc (NYSE: BRK.A)(NYSE: BRK.B). According to Bloomberg, Buffett owns around 16% of Berkshire, including around 39% of all Class A shares. Class A Berkshire Hathaway shares are today priced at US$469,805 each (not a typo).

But unlike most shares, Berkshire Hathaway ended up enjoying a very solid January. The shares rose around 3.4% last month. And that is the primary reason Buffett's net worth followed suit.

But most of the other billionaires on the list, unlike Buffett, have their fortunes tied up in technology companies. Musk and Bezos have their stakes in Tesla and Amazon.com Inc (NASDAQ: AMZN). While Zuckerberg, Gates and Page have large chunks of Meta Platforms Inc (NASDAQ: FB), Microsoft Corporation (NASDAQ: MSFT) and Alphabet Inc (NASDAQ: GOOG)(NASDAQ: GOOGL) respectively.

All of these companies took a battering last month, and are the primary reasons why these billionaires saw their fortunes take a commensurate hit.

Buffett has been ridiculed for many years for not taking larger positions in some of the US's largest tech companies. Now he's the one laughing all the way to the bank.