This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

The recent sell-off in the stock market hasn't spared crypto; Bitcoin is barely up over the past year and down almost 60% from its all-time high. Shares of cryptocurrency technology company Coinbase Global (NASDAQ: COIN) are facing a similar struggle, down roughly the same amount. Bitcoin and Coinbase tend to trade together, so the recent slide could be seen as an opportunity for investors to consider Coinbase as a long-term holding. Here's why.Bitcoin influences Coinbase stock

Coinbase is a cryptocurrency technology company, but its primary business is its exchange that allows people to buy and sell crypto. It charges transaction fees for these trades, generating revenue. Users can buy and sell nearly 100 different cryptocurrencies on Coinbase, but Bitcoin and Ethereum are the two largest, contributing 21% and 22% of transaction revenue, respectively. All of the other cryptos add up to the remaining 57%.

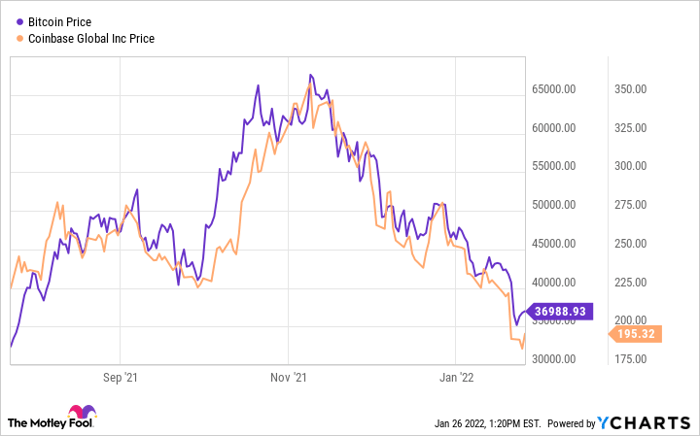

Bitcoin price. Data by YCharts.

The strong link between Coinbase and Bitcoin seems to influence how the stock trades. You can see in the above chart how they show nearly identical price action. But there's a crucial difference between the two assets: Coinbase's stock price is a function of supply and demand in the short term, but it's a real business that generates revenue and earnings, which tend to influence a stock's value over the long term. Cryptocurrency prices, including Bitcoin's, are almost solely a matter of supply and demand; they don't have underlying fundamentals, which could make them more volatile. Bitcoin's recent drop in price may be influencing Coinbase's stock, regardless of the company's underlying financials.Stellar financials

Cryptocurrency has become increasingly mainstream in the investment community, both among retail users and institutions. In Coinbase's 2021 third quarter, trading volume rose to $327 billion from just $45 billion the year-earlier period. This leap in volume created triple-digit revenue growth for Coinbase; revenue in the third quarter increased more than 300% year over year, but declined from the previous quarter, indicating how the business can fluctuate based on how actively crypto is trading on the platform. The business is very profitable because Coinbase doesn't need to spend much to maintain its platform. It turned 25% of its revenue into free cash flow in the 2021 third quarter, and $406 million of its $1.2 billion in revenue fell to the bottom line, a net profit margin of almost 33%.

COIN revenue (quarterly YOY growth). Data by YCharts. YOY = year over year.

Analysts are looking for full 2021 revenue of $7.29 billion, which puts the stock at a price-to-sales ratio of less than 6, despite its tremendous growth. Expected earnings per share (EPS) for 2021 are $13.06, a price-to-earnings (P/E) ratio of just under 15. The company is growing and is profitable, yet the stock trades at almost half the P/E ratio of Coca-Cola, which produces EPS growth at a mid-single-digit rate! Now, Coca-Cola is a more proven business than Coinbase, and investors might not be sure yet of crypto's future, which would, in turn, mean that Coinbase's long-term prospects are uncertain. Still, the financials seem to be easily justified by this low valuation. If sentiment toward crypto picks up in the future, it could create a lot of upside in Coinbase's stock via a higher valuation.A long runway for growth

In other words, an investment in Coinbase probably means that you're a believer in cryptocurrency as a whole. Assuming that crypto has a long-term future, the company is well positioned for many potential growth opportunities. It's going to release Coinbase Card, a physical payment card that lets you spend any assets in your Coinbase portfolio (both U.S. dollars and cryptocurrencies), earning crypto rewards. Hardly any businesses accept crypto as payment, and while this isn't a direct solution, it could significantly help crypto investors get more use out of it. Coinbase is also developing a marketplace for non-fungible tokens (NFTs), digital assets that use blockchain technology to authenticate and record their ownership. The waiting list for this marketplace runs to more than 2.6 million names, making it potentially the largest NFT marketplace at launch. According to investment bank Jefferies, the NFT industry is small but rapidly growing, and could reach $80 billion in value by 2025.There could be ups and downs along the way

More people are steadily adopting cryptocurrencies, so Coinbase's role as one of the primary exchanges for these digital assets could make for tremendous long-term growth. However, it's important to remember that Coinbase might be more volatile than most stocks. So much of its current revenue comes from transaction volume, which can fluctuate depending on the overall price level of cryptocurrencies. Coinbase might see periods of explosive growth, and then it might contract. Investors will want to keep this in mind and remember that it's the long-term trends that matter most. This is a young company in a rapidly growing industry; the road will probably be bumpy, but the destination could be worth it.This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.