This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

It wasn't all that long ago that many investors viewed Bitcoin (CRYPTO: BTC) as an ideal hedge against inflation. They reasoned that the cryptocurrency was like gold -- long considered to be a solid inflation hedge -- in one important way. Bitcoin was a limited resource, with a maximum of only 21 million coins allowed to exist.

However, this theory doesn't claim the luster that it once did. Here's why.

The numbers don't lie

Inflation remained low throughout the last decade. Meanwhile, Bitcoin delivered impressive gains. There wasn't a compelling reason to dismiss the idea that the cryptocurrency could serve as a good hedge against inflation with inflation rates at historical lows.

Then the COVID-19 pandemic changed everything. The federal government, afraid of the pandemic's economic impact, responded with unprecedented stimulus packages. At the same time, supply chain disruptions resulted in many businesses being unable to keep up with demand. After a long hibernation, inflation began to rear its ugly head once again.

It was the perfect scenario for Bitcoin to show just how great of an inflation hedge it could be. But it didn't.

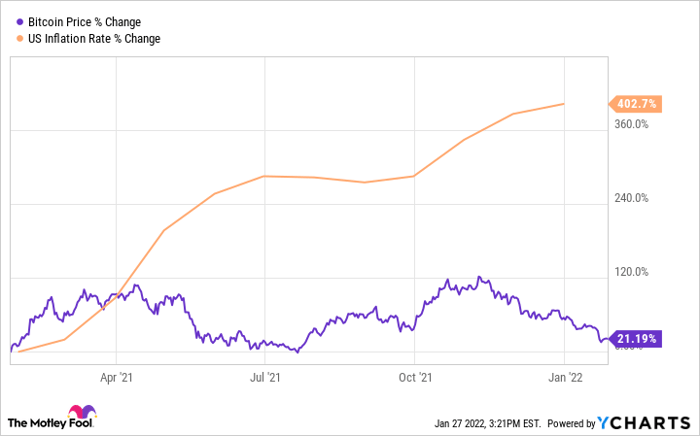

Bitcoin Price data by YCharts

No, Bitcoin didn't completely fall apart. However, over the past 12 months, the cryptocurrency took investors on a rollercoaster ride. It's up, but only by a little over 20%. Bitcoin is currently near its lowest level in six months.

The inflation rate, though, has more than quintupled during the same period. The numbers don't lie: Bitcoin has proven to be an abysmal hedge against inflation.

Bitcoin's underlying problem

Why isn't Bitcoin better at hedging against inflation? We can easily rule out one possible reason. It isn't that a large number of new digital coins have been mined. The number of Bitcoins in circulation has risen by less than 1.8% over the past 12 months.

The primary underlying problem for Bitcoin is that for any asset to be an inflation hedge, investors must actually believe that it will hold its value as inflation rises. It's abundantly clear that isn't the case with Bitcoin.

Bitcoin is only as valuable as investors believe that it is. It doesn't have any real intrinsic value like stocks do.

Investors think that cryptocurrencies, in general, are risky and volatile. And they seem to be lumping Bitcoin in with every other digital coin. Bitcoin has fallen roughly the same amount as some altcoins such as Dogecoin over the last three months.

A hedge in waiting?

Don't throw in the towel on Bitcoin as an inflation hedge just yet, though. There's still a possibility that the cryptocurrency could be exactly what investors once hoped it would be.

Increased adoption of the cryptocurrency would help. The more real-world utility that Bitcoin has, the more justifiable its valuation will be. At some point, the digital coin's valuation could become more stable.

If and when this happens, Bitcoin's fluctuations could inversely correlate with inflation rates much more than they do now. The cryptocurrency isn't an inflation hedge yet, but it just might be a hedge in waiting.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.