This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Fantom (CRYPTO: FTM) is under the radar right now, but probably not for long. The crypto had an amazing run-up last year. The coin sold for $0.02 a year ago. Now it's trading at $3 a coin.

Fantom is jumping because it's a layer 1 protocol with super-fast speeds, like Solana (CRYPTO: SOL). In 2021, those two coins skyrocketed in value 14,000% and 11,000%, respectively. Fantom is a lot smaller with a market cap of $7 billion versus $43 billion for Solana. I think part of that discrepancy is because Solana, unlike Fantom, can be bought and sold on Coinbase (NASDAQ: COIN), the biggest crypto exchange. (You can buy the coin on another exchange, Gemini.)

I'm expecting the smaller coin to outperform Solana yet again in 2022. Here's why you might want to own Fantom coin.

1. It might be the fastest blockchain out there

Last year the crypto markets went crazy for Ethereum (CRYPTO: ETH) competitors. Ethereum is the major platform for the crypto universe. But interest in crypto is skyrocketing, and the Ethereum network is creaking under the strain. The "gas fees" (the cost of validating a transaction on the Ethereum blockchain) hit $300 at one point. In comparison, a transaction on Fantom or Solana costs a fraction of a a penny.

Why are the fees so cheap? Speed. Solana averages 50,000 transactions per second, versus 14 per second on Ethereum. Fantom is not as fast as Solana, but it's still way ahead of Ethereum; in a test run back in 2018, its blockchain processed 25,000 transactions per second. But Fantom has a pretty solid claim to being the fastest blockchain if you look at time to finality. This is arguably the most important statistic, as that's the moment when a transaction has been fully validated on the chain. Fantom's time to finality is about a second, versus 13 seconds on Solana and more than a minute on Ethereum.

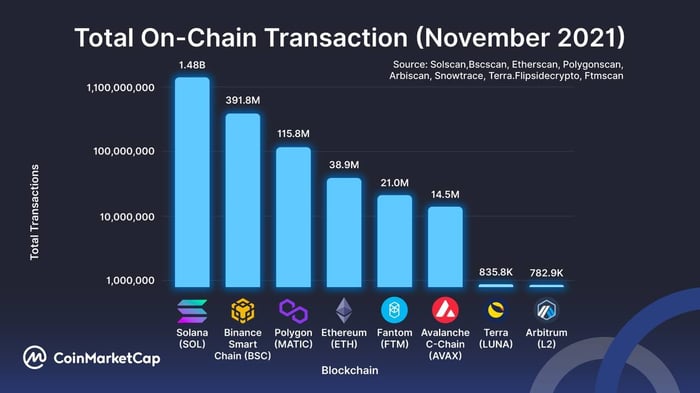

Fantom is also rocking the total number of transactions on the blockchain. A year ago, Fantom averaged of 4,000 transactions a day. Now the network is averaging 750,000 a day. That's an amazing growth rate. Fantom is already fifth in the number of transactions, and it has zoomed past much bigger coins like Avalanche (CRYPTO: AVAX).

Image source: CoinMarketCap.

2. It's compatible with Solana and Ethereum

One of the challenges in the blockchain universe is compatibility. It can be hard to move a virtual wallet from one blockchain to another. So in the blockchain universe -- like Silicon Valley -- a lot of these blockchain networks are frenemies. They're all competing and want to win. But they also must play nice and work together.

Fantom, like most Ethereum competitors, is compatible with the Ethereum Virtual Machine (EVM). This makes it easier for engineers experienced with Ethereum to develop decentralized apps (dApps) for the Fantom blockchain. And it makes it easy for dApps on the Ethereum blockchain to migrate to the Fantom blockchain to save money.

Solana is something of a maverick in that it's not Ethereum compatible. That puts its blockchain outside the Ethereum universe. But what's fascinating is that Fantom is also in the Solana ecosystem. That flexibility is a strength. Regardless of who comes out on top, Ethereum or Solana, Fantom should be just fine because it's compatible with both systems.

3. Major players are backing the coin

If you've done any crypto investing, you've probably heard of Sam Bankman-Fried. He's No. 58 on the Forbes 400 list with a net worth of $26 billion, making him the richest crypto magnate on the list.

Bankman-Fried made a lot of money by starting up the crypto trading exchange FTX (CRYPTO: FTT). But he's also a notable (and early) investor in Solana. Bankman-Fried once got in a Twitter fight over the price of the coin. He and a Twitter user named CoinMamba debated the worth of the Solana coin at $2, $2.05, and $2.38. Finally, on Jan. 9, Bankman-Fried tweeted, "I'll buy as much SOL has you have, right now, at $3. Sell me all you want." The tweet became famous as the coin skyrocketed to $149 by the end of the year.

Bankman-Fried is also a major backer of Fantom. His firm, Alameda Research, bought $35 million in Fantom coin back in February. This happened at the same time that Fantom started to integrate its blockchain with the Solana network.

While Bankman-Fried might be the richest backer of Fantom, the most important is probably Andre Cronje. He's the founder of Yearn Finance (CRYPTO: YFI) and is one of the architects of the decentralized finance (DeFi) revolution. Cronje is a technical advisor to Fantom and helped develop its blockchain. He's already created a non-fungible token (NFT) marketplace on Fantom that's a direct competitor to OpenSea, the largest NFT marketplace. Cronje is also working on a secret project to be released on the Fantom blockchain later this year.

Given its support by major players in the industry, its amazing speed and stratospheric growth rates, and its low valuation versus other major coins, Fantom's crypto is likely to soar even more in 2022. While it probably won't repeat the 14,000% growth of last year, the upside potential here is still very high. I own this coin and I'm buying more.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.