This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

I don't know about you, but my portfolio has been bleeding red since the beginning of the year. Multiples have been contracting, and a lot of former high-flyers are amazing bargains right now. On Monday, I started buying my favorite crypto again. (trading disclosure rules prevent me from saying which one.) And happily, that coin was up nicely on Tuesday. So maybe we've reached a bottom in crypto. And I've noticed a few of my big stock losers, like Smile Direct Club, were up big on Tuesday, too.

Overall, the Nasdaq is down 11.6% since the beginning of the year (as of Wednesday afternoon). That's a pretty big hit considering the index is dominated by mega-caps like Apple, Amazon, and Microsoft. Let's take a look at some prior crashes -- September 2001, the Great Recession of 2008-09, and the coronavirus sell-off in 2020 -- and see how the stock market responded after these sell-offs.

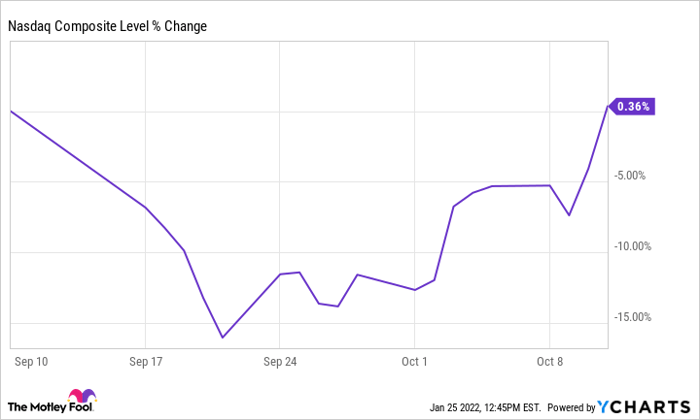

1. Sept. 20, 2001 -- Nasdaq has dropped 13%

After the terrorist strike against Wall Street, the stock market panicked and there was a quick sell-off. Nine days after the towers fell, the Nasdaq was down 13%. There would be one more ugly day. And then the stock market took off. A month after the terrorist attack, the stock market was back to where it was before.

^IXIC data by YCharts

The absolute bottom was about a 16% drop for the Nasdaq. But people who bought when it was down 13% definitely benefitted.

Of course, the September 2001 crash was caused by a specific event. Today it's more like a death from a thousand cuts. How does the market respond when bad news comes in waves? Let's look at the Great Recession in 2008-09, and how that affected the Nasdaq.

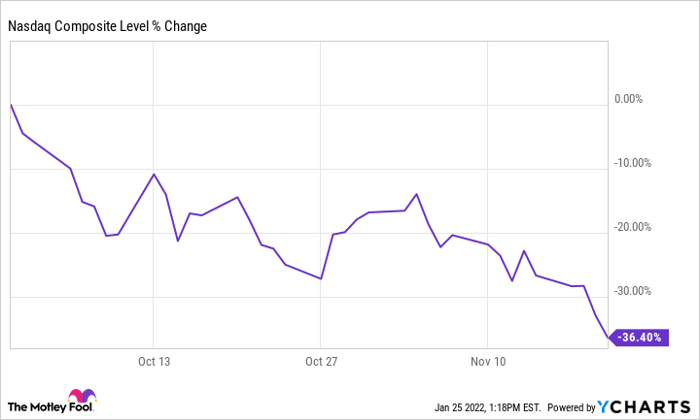

2. Oct. 1, 2008 -- Nasdaq has dropped 13%

The real estate crash was particularly scary for the markets. A lot of banks imploded, and some went out of business. The government had to rescue others. The crash started in September 2008, and a month later Nasdaq investors were seeing double-digit percentage losses.

Of course, the Nasdaq is a tech-heavy index. It's not dominated by real estate companies or banks. And you might think that stocks like Amazon or Microsoft would be immune to this sell-off. But fear is contagious. And those optimistic bulls who figured that "down 13%" might be a buy signal for the Nasdaq, well, they were slaughtered. If you bought the Nasdaq on Oct. 1, 2008, this is what happened next.

^IXIC data by YCharts

Ouch! The Nasdaq continued to plummet. The crash got worse, and worse, and worse. Finding a bottom is always tricky. And there is no "the Nasdaq has dropped 13% and it has to go up now" rule. So lesson No. 2 is that short-term pain today does not mean there will be short-term happiness tomorrow. Bear markets can hurt for a while.

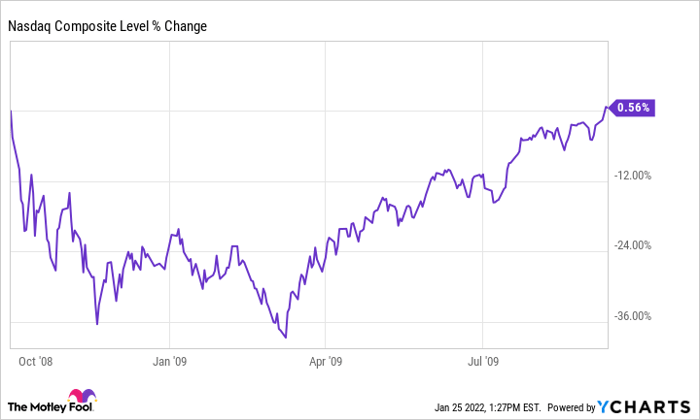

But will the markets recover? Of course! They always do. In this case, it took almost a year for the Nasdaq to get back to prior levels.

^IXIC data by YCharts

Over the next decade, the Nasdaq would almost quadruple! So while it definitely feels scary (and stupid) to buy stocks when the markets are shedding value, over time that's a great move. The key, of course, is to make sure you're buying the right stocks. When the market is killing stocks indiscriminately (which is happening right now, in my opinion), it's always a great time to buy the best stocks in the world. When the panic subsides, those are the ones that will recover quickest, continue to soar, and take the Nasdaq back to positive returns.

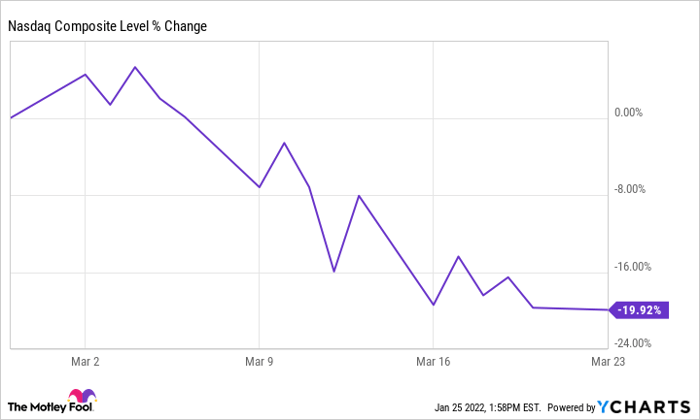

3. March 1, 2020 -- Nasdaq has dropped 13%

The stock market was doing fine until Feb. 19, 2020. That's when people started to take alarm at what was happening in Wuhan, China, and at the fast-spreading virus that originated there. The Nasdaq lost 13% of its value in a couple of weeks. So if you bought stocks in an optimistic hope that this viral threat was overhyped, well, you were wrong. March 1, 2020, was a horrible time to buy stocks.

^IXIC data by YCharts

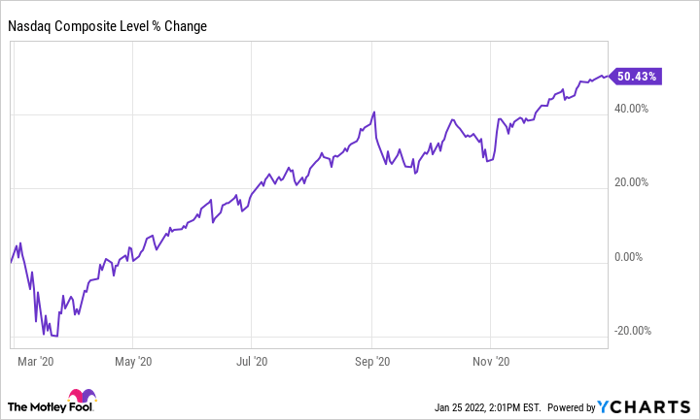

So the market's dropped 13%, and you buy, and the market drops another 20% from there. Brutal. But if we expand our time horizon a little, we see that this was actually a great investment. How did that "stupid" investor who bought on March 1 do in 2020? They made a nice 50% gain for the year.

^IXIC data by YCharts

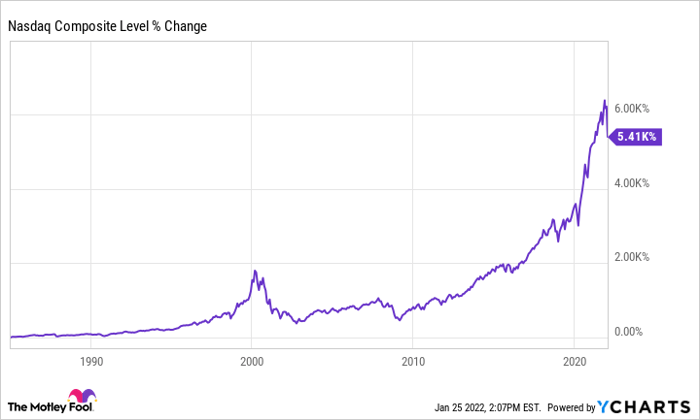

These charts confirm what we know to be true. Nobody knows what will happen in the short term. Where will the stock market be next week? No idea. But these sharp sell-offs can be wonderful entry points for patient, long-term investors. And some fantastic stocks are on sale right now. We don't know when stocks will recover. But the future is bullish. Up and to the right is the long-term trend for the stock market, and the Nasdaq.

^IXIC data by YCharts

Don't get caught up in any short-term fright. Stay focused on the long term, continue buying shares of the strongest companies in the world, and you'll do fine.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.