This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

One of the common investment theses behind Bitcoin (CRYPTO: BTC) is that it's a great hedge against inflation. There are only 21 million Bitcoin available once they're all mined, limiting supply. In theory, this limited supply should mean that Bitcoin is a good hedge against the increased supply of the U.S. dollar.

This theory comes into question when we look at the data about Bitcoin's price trends and real inflation. Does Bitcoin really trade as an effective hedge to inflation, or is there something else to its moves?

Why Bitcoin is viewed as an inflation hedge

The theory behind Bitcoin as an inflation hedge is simple enough. The number of Bitcoin is limited to 21 million, while the number of U.S. dollars typically increases over time. With everything else being equal, if the supply of the U.S. dollar increases, the value of Bitcoin in dollars should also increase.

Here is an extremely simplistic example of the value of Bitcoin if the supply of dollars doubles. I assume that the "market cap" of U.S. dollars and Bitcoin are equal in both scenarios.

| Currency | Supply Scenario 1 | Price Scenario 1 | Supply Scenario 2 | Price Scenario 2 |

|---|---|---|---|---|

| U.S. Dollar | 1 trillion | $1 | 2 trillion | $1 |

| Bitcoin | 21 million | $47,619 | 21 million | $95,238 |

Note: Author's calculations.

If the supply of U.S. dollars doubles, then it makes sense that the value of a Bitcoin would double in relation to the U.S. dollar. The market doesn't always work in this simple way, though.

Bitcoin hasn't been a hedge so far

If we go back to pre-pandemic days, Bitcoin doesn't look like a hedge at all. Bitcoin rose in popularity in late 2017 but then crashed in 2018 and early 2019, and that didn't have anything to do with inflation. Over this time, the M2 money supply rose 25.3%, and gold would have been a better direct hedge, rising 51.9%.

Bitcoin Price data by YCharts

More recently, Bitcoin hasn't acted like a hedge as actual inflation has taken hold. You can see below that inflation, and inflation expectations, have been rising all year, but Bitcoin is actually down compared to late February. Investors looking to hedge inflation would have been better off buying the iShares TIPS Bond ETF (NYSEMKT: TIP), a bond fund of inflation-protected treasuries.

Bitcoin Price data by YCharts

What is Bitcoin if it's not a hedge?

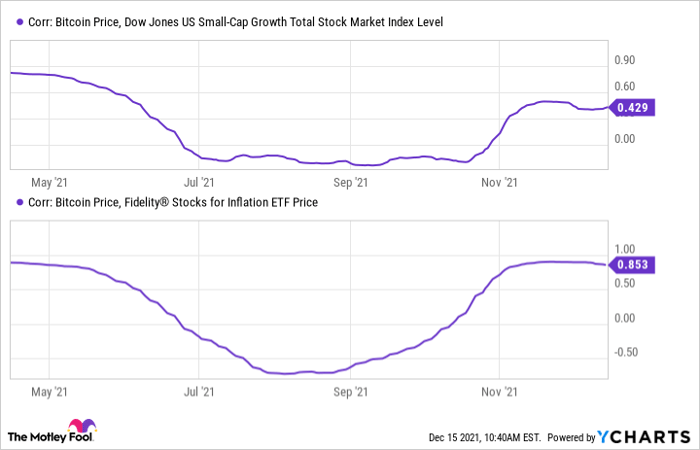

Over the last decade, we've seen Bitcoin's value swing wildly. However, it hasn't been correlated with inflation in any meaningful way. You can see below that Bitcoin hasn't been consistently correlated with growth stocks or inflation stocks and for large portions of the last year were negatively correlated (a correlation coefficient of 1.0 means they're highly correlated while a coefficient of -1.0 means they move in opposite directions).

Fundamental Chart data by YCharts

I see the recent rise in Bitcoin as a speculative move driven by millions of people with excess stimulus cash and ample time to trade in the high-flying cryptocurrency market. That has brought in more institutional money, pushing values even higher. At the end of the day, it's not clear whether Bitcoin is like digital gold, some kind of utility, or just a speculative asset.

From what I can see, based on the fact that inflation is rising in 2021 while Bitcoin is heading lower, Bitcoin isn't a good inflation hedge, and investors should seek a better investment thesis for this digital asset.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.