This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Gas fees -- or the fees paid to process and validate transactions in a crypto ecosystem -- have become a huge problem for the Ethereum (CRYPTO: ETH) blockchain. What was once an annoyance is now a very real cost, with transactions costing $100 or more just for simple acqusitions.

Gas fees for the proof-of-work blockchain are a standard feature, but for Ethereum they're starting to drive developers and users to other cryptocurrencies. Until a transition to a proof-of-stake transaction process is completed in 2022, gas fees will be high and Ethereum doesn't have a great answer to cryptocurrencies offering lower fees and faster transaction times. And these alternative cryptocurrencies are Ethereum's biggest competition.

Gas as a leading indicator

The high cost of gas fees earlier this year was initially a positive sign for Ethereum. It meant there was so much demand on the blockchain that miners could charge high fees to complete transactions. High fees are correlated with high demand, and more demand on a crypto blockchain is a good thing, or so it would seem.

The problem is that high-enough gas fees will push projects to lower-cost networks. Non-fungible token (NFT) projects are booming on Solana (CRYPTO: SOL) as a result of lower transaction costs and an improving suite of tools for developers. High-value NFTs are still on Ethereum, but a project selling an NFT for $100 would make little sense on Ethereum today due to gas fees potentially costing as much as the NFT itself.

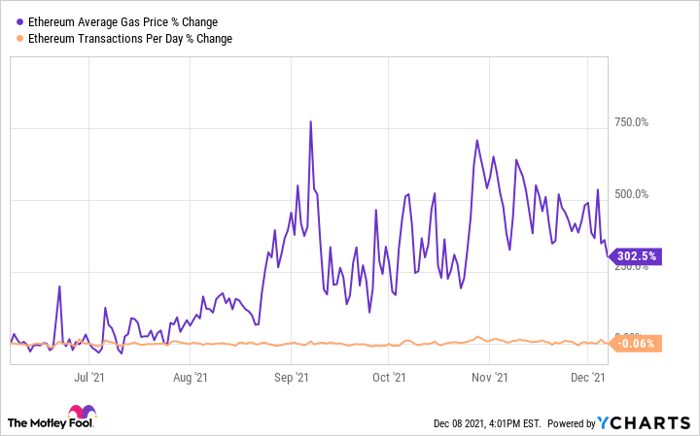

This brings us to the problem for Ethereum ahead of a proof-of-stake upgrade. The price of gas is high, but if the price of gas falls, it would likely be an indicator that transaction volume is down because users are moving transactions elsewhere. You can see below that transaction volume is actually flat over the past six months, despite more people getting involved in crypto. For perspective, Coinbase (NASDAQ: COIN) said that its number of monthly transacting users has jumped nearly 4x in the last year from 2.1 million to 7.4 million in the third quarter of 2021.

Ethereum average gas price data by YCharts.

This is a Catch-22 for Ethereum. If gas fees are high, it's an indication of high demand, but if gas fees go down, it could indicate that crypto developers and users have moved elsewhere, taking their demand with them.

The developer challenge

I don't think there will be one cryptocurrency to rule them all, long term. Some projects will live on one blockchain while others will live on another. But Ethereum had a clear advantage over upstarts like Solana and Cardano (CRYPTO: ADA) as recently as this summer, and now smaller cryptocurrencies are catching up.

If developers move their projects to a different crypto blockchain, it will undermine the value of Ethereum. As someone who has bought NFTs on Ethereum and Solana, I would prefer a Solana project over an Ethereum project in a heartbeat. The longer that gas fees are high, the more people will agree with that assessment.

Crypto's utility moment

At a time when more and more people are coming on board with cryptocurrency and NFTs, and other projects are finding real utility in the market, Ethereum is facing transaction costs that are untenable in the long term. That's an indication of high demand on the network, but it also means that competitors will be selling themselves as lower-cost blockchains, and that's a compelling feature for those new to cryptocurrency today.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.