The S&P/ASX 200 Index (ASX: XJO) is having a pretty disappointing day of trading so far this Tuesday. At the time of writing, the ASX 200 is down by 0.11% at 7,371 points. But one ASX 200 share is putting that loss well and truly to shame. That would be the Australian Ethical Investment Limited (ASX: AEF) share price.

Australian Ethical shares are currently up a very pleasing 7.72% to $12.97 a share so far today, after closing at $12.09 a share yesterday afternoon and opening at $12.04 this morning.

Well, unfortunately, it's not entirely clear why Australian Ethical shares are rocketing higher today. There has been no news or announcements out of this ethically-focused fund manager today. Nor any other major developments as of yet.

Why is the Australian Ethical share price rocketing today?

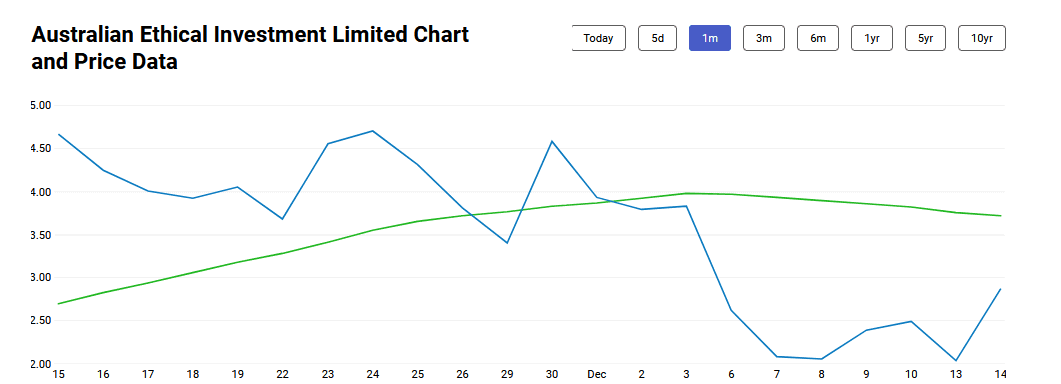

However, it's very important to keep in mind this company's recent performance. Sure, today's move looks like an amazing gain for shareholders (which it is). But consider this: Australian Ethical shares are still down by close to 12% over the past month. This is what today's move looks like in that context:

Just last week, we looked at why it has been such a dreary time for Australian Ethical shares of late. It all seemed to stem from the earnings guidance update that Australian Ethical put out on 1 December. Investors seemed supremely disappointed with the data Australian Ethical released in this update. It included a 9% increase in funds under management (FUM) over the 4 months to 31 October. As well as an expectation of underlying profit before tax of between $5 million and $5.5 million for the half year ending 31 December, an 8% increase on its previous half year to 31 December.

We also touched on Australian Ethical's valuation. At today's pricing, this company still commands a price-to-earnings (P/E) ratio of 126.58. That's arguably very high, considering that the broader P/E ratio average for the entire ASX 200 is currently sitting at around 17.53, according to iShares.

So it could be said that today's pricing pop is just a liftoff from the recent lows we have seen with this company. Remember, the Australian Ethical share price is still up an incredible 164% year to date in 2021 so far.