How has the Medibank Private Ltd (ASX: MPL) share price performed against the S&P/ASX 200 Index (ASX: XJO) in the last 3 months? Good question!

The Medibank share price certainly didn't have a pleasant start to the week today. It's closed at $3.43 a share, down 1.3% for the day.

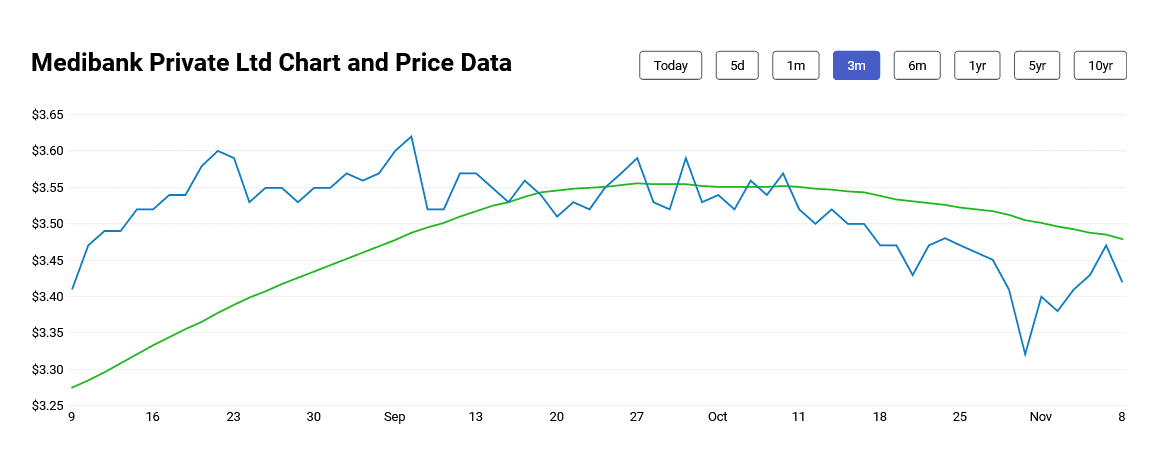

But how has it fared over the past 3 months? Well, back on 9 August, Medibank shares closed at a price of $3.41 each. That means Medibank shares have gone almost nowhere over the past 3 months (well, a gain of 0.59%) going off those bookend dates.

But that's not to say the share price did nothing that whole time. In fact, on 7 September, the company hit a new 52-week high of $3.62 a share. By the back end of October, this private health insurance giant descended as low as $3.32 a share. That's a difference of around 8.3%.

You can see this visually represented in the graph below:

But, as it turns out, this particular 3 month period has resulted in the Medibank share price going nowhere. That's just how these things work sometimes. So how did the ASX 200 perform by comparison?

Well, the ASX 200 closed at 7,538.4 points back on 9 August. Today, it finished up at 7,452.2 points, a drop of 1.14% over the same period. Suddenly, Medibank's anaemic performance over this period doesn't look quite so bad, seeing it was still a market-beating investment.

Saying that, there was another silver lining for Medibank shareholders during this period. On 30 September, Medibank paid out its final dividend for FY21, a 6.9 cents per share payment, fully franked. This dividend in itself is worth a yield of roughly 2% on today's pricing, so shareholders had that to bank over the past 3 months as well.

Medibank Private share price snapshot

Whilst Medibank has had a rather uninspiring 3 months, its longer-term performance is far more robust. Year to date, Medibank shares are up a healthy 13.95%, outperforming the ASX 200's 11.49% performance over the same period. Over the past 12 months, Medibank shares are also up by 26.1%, again beating the ASX 200's 20%.

At Medibank Private's closing price of $3.43 today, this ASX 200 company has a market capitalisation of $9.45 billion, with a trailing annual dividend yield of 3.7%.