Of all the ASX 200 blue chip shares, none arguably has a more interesting share price history than that of CSL Limited (ASX: CSL), the giant healthcare company that dominates the S&P/ASX 200 Index (ASX: XJO). CSL is presently the second-largest company on the ASX boards, just behind Commonwealth Bank of Australia (ASX: CBA).

But it's had quite the history over the past 10 years. CSL used to be regarded as something of a perfect ASX blue chip growth share. It could seemingly do no wrong, rising in value year after year, and often by double-digits.

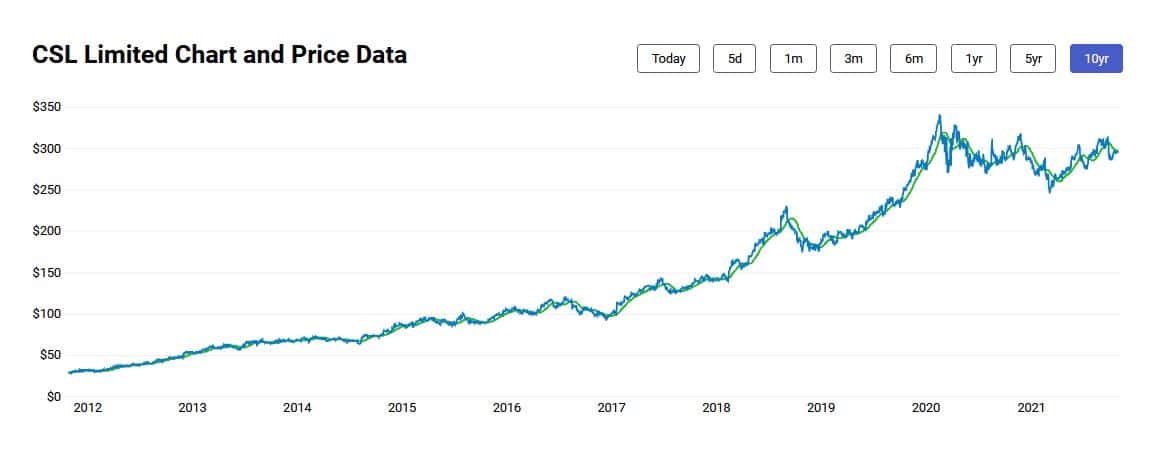

But the company's fortunes have looked a whole lot different over the past 2 years or so. But enough with the words, let's put this in some visual context:

CSL share price history visualised

As you can clearly see above, we can see three different growth phases playing out: virtually uninterrupted share price growth from 2012 to late 2018. Share price growth resuming from early 2019 to early 2020. And a now-long period of stagnation stretching from the onset of the coronavirus pandemic until today.

Yes, CSL shares did have some major pullbacks, most notably in late 2016, mid-2017 and late 2018. Some of these pullbacks were rather dramatic too. For example, between August and December 2018, CSL shares lost more than 20% of their value. But the shares went on to recover every time.

Well, at least until the pandemic. As is evident above, CSL has unequivocally been stuck in something of a funk for the past 18 months or so. The company remains roughly 12% below its all-time high of $$336 a share that we saw back in February 2020. That's on the CSL share price of $297.02 at the time of writing.

Even so, the raw data shows CSL has given its shareholders a capital return of roughly 894% over the past decade (not including dividend returns). That represents a compound annual growth rate of 25.8% per annum over the decade. Nothing to complain about there!

At the current CSL share price of $297.02, this company has a market capitalisation of $134.7 billion, a price-to-earnings (P/E) ratio of 42.6 and a dividend yield of 0.99%.