As the end of October draws near and November approaches, investors might be pondering: how do ASX share prices typically perform in the eleventh month of the year? To avoid a thesis-long analysis, this article keeps the assessment narrowed to the S&P/ASX 200 Index (ASX: XJO).

Often the best approach to investing is simply applying dollar-cost averaging (DCA) and investing regularly regardless of the prevailing conditions. However, historical data can sometimes help us understand reoccurring themes. An example is the old "sell in May and go away" thematic.

How does November compare?

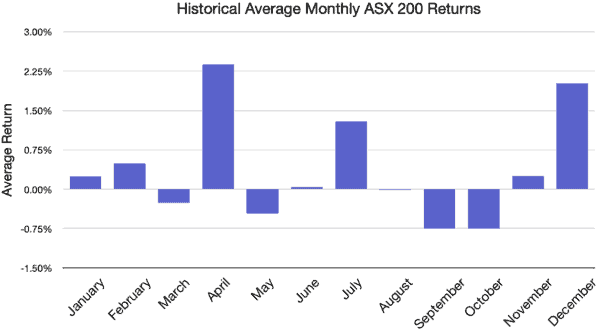

To establish what November typically looks like, we reviewed the historical monthly data of the Aussie benchmark index since 1970. While there are many ways to interpret the data, we have opted for the 'average monthly return' analysis.

Taking the average returns of each month across the past 51 years indicates that historically the best returns occur during April — how Foolish!

Following on from there, we can see the prevalence of the ASX 200 Christmas rally, with December being the second-best performing month on average for ASX share prices.

On average, November has been the fifth-highest returning month of the year. However, considering November has, in the past, been the beginning of multiple months of positive returns, investors might consider it a prime point of entry into the market.

What are the best months for ASX share prices in history?

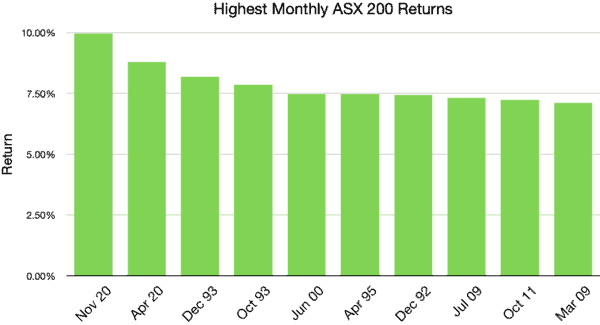

We use the term 'in history' loosely, as 1970 is as far as our ASX 200 dates back to. Regardless, our findings indicate that the best month on record was indeed… November. In fact, we only need to look back 12 months to see the greatest monthly returns on record.

It appears 2020 was the year for setting records with April of the same year taking out the second spot.

Finally, it is worth noting that although October is tied with September as the worst month on average for ASX 200 share prices, October 1993 comes in as the fourth-highest monthly performance in history. This simply illustrates the unpredictable nature of the stock market and ASX share prices.

Ultimately, investing for the long term helps alleviate this short term unpredictability.