The Transurban Group (ASX: TCL) share price has been off to a troubling start to commence the walk through October.

At the time of writing, shares in the road toll operator are changing hands at $13.78, a corresponding 0.15% drop from the market open today.

Transurban shares are on the move as the company released its quarterly update for the quarter ending September 30 2021.

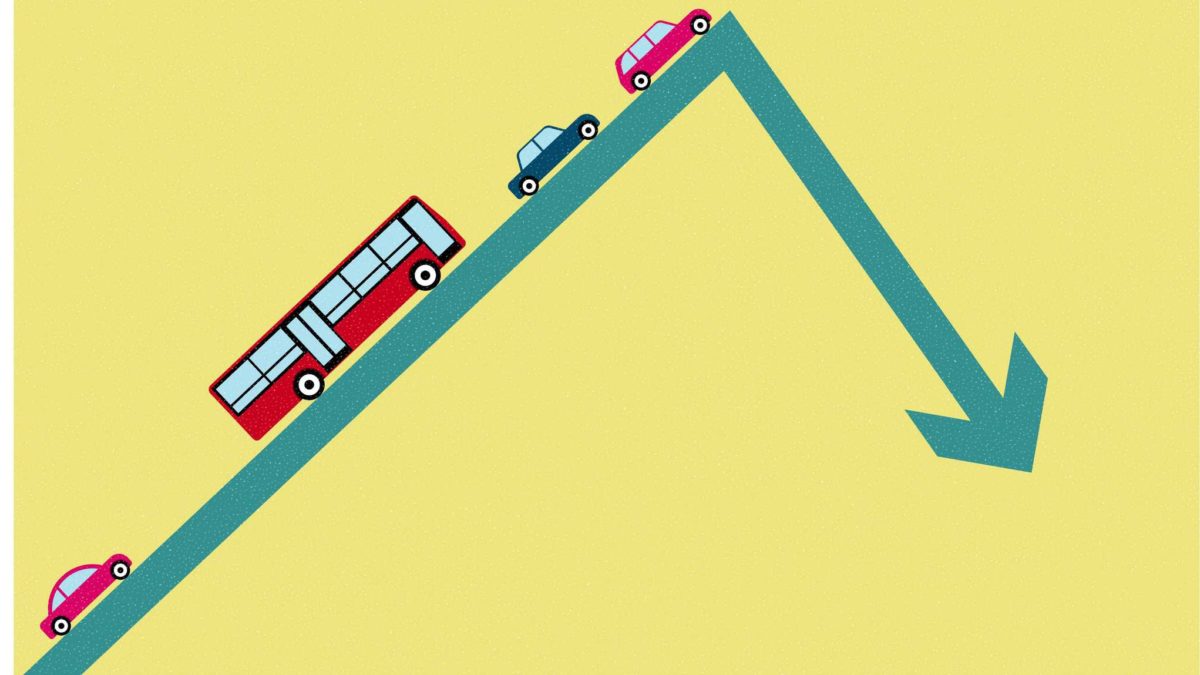

Transurban share price slips as average daily traffic pulls back

Key investment takeouts for Transurban coming out of the latest quarter include:

- Significant decrease in overall average daily traffic year on year, due to Government enforced lockdowns

- Melbourne and Brisbane traffic increased, whereas Sydney traffic volumes were 44% down year on year

- Recovery of traffic numbers in some jurisdictions like Montreal and Washington are balanced by uncertainties from the Federal and State Governments in Australia

- WestConnex Tunnel excavation is now basically complete, with 11km of road pavement now laid down

- First cars expected at WestConnex in FY23.

What did Transurban get up to this quarter?

In its report, Transurban explained that overall average daily traffic (ADT) volumes came in 12.4% behind this same time last year and 34.5% when compared to 2019.

The company advised the down-step in ADT is primarily the result of government mandated lockdown restrictions, particularly in Melbourne and Sydney – two cities critical for Transurban's Australian operations.

This effect was made clear as ADT in Brisbane actually increased this quarter, as case numbers there remained low and restrictions on mobility were light throughout the last three months.

However, irrespective of this, Melbourne ADT actually managed to reclaim 30.7% towards its pre-COVID levels, with a large uptick in weekend/public holiday traffic.

Sydney traffic was the offsetting factor, driven by a 44% decrease in ADT from the year prior, with the shutdown of the construction industry certainly not helping the outcome.

In both Montreal in Canada and the Greater Washington Area in the US, traffic numbers are showing signs of recovery with a 39% increase in ADT this quarter. However, they are still not at pre-pandemic volumes just yet.

Perhaps the key takeout from the quarter was Transurban's confirmation that its 50% strategically-owned subsidiary, Sydney Transport Partners, will acquire the remaining stake in the WestConnex project.

The 49% stake was purchased from the NSW Government at auction last month after the company successfully raised $4.22 billion from an equity raise to fund the transaction.

As a result of the deal, Sydney Transport Partners is now the 100% owner of WestConnex, meaning Transurban shareholders are also effectively part-owners of the project.

Per the release, tunnel excavation is now 99% complete at the project, whereas 11km of road pavement has now been laid.

The company anticipates the project to accept its first run of cars and be fully operational by FY23.

Transurban share price snapshot

The Transurban share price has had an incredibly difficult year to date, leaving much to be desired for shareholders.

It's posted a return of just 1.7% since January 1 and is in the red by about 0.4% over the last 12 months.

These results have lagged the S&P/ASX 200 index (ASX: XJO)'s return of around 19% in that time.