The Identitii Ltd (ASX: ID8) share price has been a major performer on the Australian broad indices over the last few weeks.

Whereas the S&P/ASX 200 Index (ASX: XJO) has slipped 0.6% into the red over the last month, Identitii shares have soared 182%.

Let's investigate further.

Quick refresher on Identitii

Identitii is in the business of developing and licensing enterprise software for regulated companies. It derives the bulk of its revenue from the US but has a footprint in Australasia.

Its flagship product – the Overlay+ platform – helps to reduce regulatory risk without major upgrades to technology systems.

At the time of writing, Identitii has a market capitalisation of approximately $33.5 million.

What tailwinds are behind the Identitii share price?

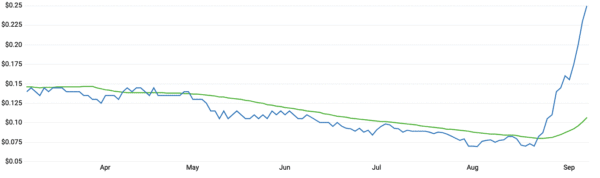

The Idenditii share price has made its major move upwards from the end of August. Prior to this, it was actually trading down and had dropped 13% since the beginning of July.

However, Identitii shares have been on the move since the company made two major announcements.

Identitii share price: major uptick since the end of August

Source: The Motley Fool

First was an announcement that the company had been granted a patent on its intellectual property (IP) in the US.

The patent was actually granted in April 2021. However, the company only confirmed the news at the end of August. Identitii also filed "additional claims" regarding its IP in the US in August, as per the release.

Next was the company's FY21 earnings release which came a day after the patent announcement.

In its report, the company recognised a 45% year on year increase in revenue to $1.4 million. Folding "grant revenue" into the equation, Identitii increased turnover to $2.7 million.

Operating costs for the year also came in 6% lower than FY20 at $8.6 million. As a result, the net loss for the year improved by 18% to $5.8 million.

The company also advised that it intends to launch its new Software as a Service (SaaS) platform in FY22. Idenditii has also signed additional licences for AUSTRAC reporting with payments service Novatti Group Ltd (ASX: NOV) that will take effect in FY22.

Finally, the company reported that investment banking giant Citibank signed a letter of intent with the company to potentially licence its Overlay+ platform for AUSTRAC reporting standards.

The Identitii share price has soared near its 52-week high since these announcements. From 20 August to date, Identitii shares have climbed 350%. That means the majority of the gains Identitii shareholders have enjoyed over the last month have arisen in the last 2-3 weeks.

Identitii share price snapshot

Identiti shares are now exchanging hands at 22 cents apiece, a 4.35% drop from the opening of trade on Tuesday. Earlier in the day, the share price reached 26.5 cents.

The Identitii share price has posted a year to date return of 37%. Despite this strength, Identitii shares have remained relatively flat over the past 12 months.

As such, the Identiti share price has lagged the broad index's return of around 25% over the past year.