The Brisbane Broncos Limited (ASX: BBL) share price has stepped firmly into the green during early trade on Tuesday.

Brisbane Broncos' shares are now exchanging hands at 84 cents apiece, a 16% jump from the opening of trade.

Let's investigate further.

Quick recap on Brisbane Broncos

Brisbane Broncos is a sports entertainment business that is best known for its ownership of the National Rugby League (NRL) football team of the same name.

The Brisbane Broncos franchise generates revenue from sponsorships and from sales of its merchandise and memberships.

At the time of writing, Brisbane Broncos has a market capitalisation of $71 million.

What tailwinds are behind the Brisbane Broncos share price lately?

There has been no market sensitive information released for the company on Tuesday.

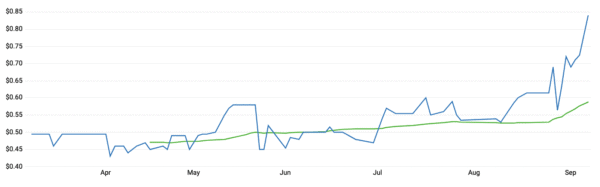

However, the Brisbane Broncos share price has been on the move since the company reported its half year results in early August.

Brisbane Broncos' share price – significant uptick since August to date

Source: The Motley Fool

In its report, the company recognised a net profit before income tax (PBIT) of $3.17 million, a significant increase from $22,000 a year ago.

This came from revenue recognition of $25.34 million in the half year ended June 30 2021, underscored by an NRL grant of $7.2 million and sponsorship growth of 26% over the year.

One factor that is important to note, is that the performance for the same time in 2020 "reflects the unprecedented negative impact that Covid-19 restrictions had on the Group".

However, in saying this, the company's half yearly PBIT for 2019 came in at $1.3 million. This means the company still grew its profitability in 2021 when backing Covid-19 out of the equation.

Aside from these driving factors, there has been no market-moving announcements that relate to the company.

However, the recent uptick in the Brisbane Broncos share price from 27 August does show an interesting correlation to the NRL finals series.

For example, several NRL finals games are scheduled at the Brisbane Broncos' home ground, Suncorp Stadium. This is in accordance with the NRL competition being relocated to Queensland due to the Covid-19 pandemic.

In other words, this is an anomaly for the 2021 season, as the majority of NRL finals games would otherwise be played in NSW venues located in Sydney.

As a result, the group is set to benefit from revenues associated with crowd attendance at this venue, that are asymmetrical to previous years.

Brisbane Broncos share price snapshot

The Brisbane Broncos share price has posted a return of 93% over the year to date. This extends the gain over the previous 12 months to 110%.

Both of these results have outpaced the S&P/ASX 200 index (ASX: XJO)'s climb of around 25% over the past year.