The Carsales.com Ltd (ASX: CAR) share price has jumped into the green again on Monday, reaching a new record high at $25.98.

It's been a great few weeks for shares in the online automotive company, with the Carsales share price up almost 16% in the past month. In contrast, the S&P/ASX 200 index (ASX: XJO) has slipped 0.08% lower over the same period.

What are the tailwinds behind Carsales shares?

The Carsales share price has been on the move since the company reported its FY21 earnings in mid August.

In its report, Carsales recognised a 4% year on year increase in revenue, whereas earnings before interest, tax, depreciation and amortisation (EBITDA) grew 20% to $241 million.

This led to a net profit after tax (NPAT) of $131 million, a 9% increase from the year prior.

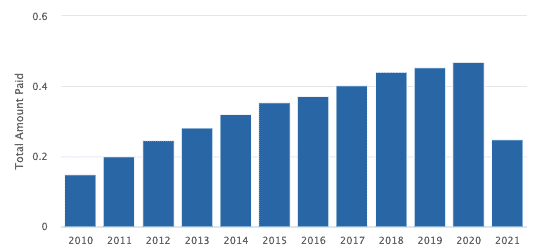

In addition, Carsales gave its dividend a 10% haircut from FY20, setting a final dividend payment of 22.5 cents per share.

Carsales dividend history 2010 – 2021

Source: The Motley Fool

Despite the dividend cut, Carsales' shares have shown strengths on the chart, as investors look towards the company's earnings growth instead.

The Carsales share price immediately shot up from $22.72 to $25.60 in the week following its FY21 earnings release, and has gained more than 14% from this event to date.

Carsales also completed the 49% acquisition of Trader Interactive in an announcement on 1 September.

Trader Interactive is a digital marketing corporation and a "provider of online market places and digital marketing products".

Carsales advised that the acquisition was financed through a successful $600 million fully underwritten pro-rata accelerated renounceable entitlement offer and an "upsize" of the company's existing debt facilities.

Given there has been no other market sensitive information for the company over the last month, it appears that investors are buying Carsales shares on the back of this momentum.

Carsales share price snapshot

The Carsales share price has climbed 31.3% into the green since January 1 and has gained 29.6% over the previous 12 months.

Both of these results have outpaced the S&P/ASX 200 index (ASX: XJO)'s return of around 25% over the past year.