The Afterpay Ltd (ASX: APT) share is one that has certainly commanded a lot of attention over the past few years. Afterpay shares are famously (perhaps infamous) for their volatility. After all, this was an ASX 200 share which fell almost 70% over just one month at the onset of the coronavirus pandemic last year, only to add more than 1,100% over the subsequent 11 months.

Afterpay is of course back at the front of the ASX 200 news feed recently, thanks to the blockbuster announcement last week that the US payments giant Square Inc (NYSE: SQ) is attempting to acquire Afterpay in full.

Since investors received Square's offer to swallow Afterpay for an all-scrip price of 0.375 shares of Square for every share of Afterpay held, the Afterpay share price has been slowly edging higher. Today, it's currently going for $132.40 a share, up 0.66% for the day.

So now that the Afterpay share price looks as though it might have found a Square groove, let's take a look back at this company's major highlights (and lowlights) over the past few years.

Afterpay share price bared

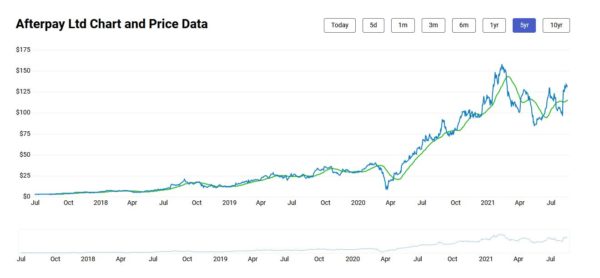

Here's the Afterpay share price over the past 5 years:

As you can see, it's been one heck of a ride. So as we discussed earlier, Afterpay had a nasty crash last year with the emergence of the COVID-19 pandemic. On February 21, 2020, Afterpay was riding high at what was then a record high of around $38-39 a share. But by March 23, Afterpay had fallen below $9, wiping more than 70% from the market capitalisation of the company in just a month.

Before this dramatic crash, Afterpay could seemingly do no wrong. Afterpay shares more than doubled across 2019, rising from around $12 at the start of the year, but finishing it at more than $30 a share. Before that, we saw similar growth in 2017 and 2018 as well.

A 2020 to remember… thanks to Tencent

But this company really stepped on the gas over the period following the COVID crash last year. Perhaps the most dramatic day in Afterpay's then-history came in late April 2020. That was when investors found out that the Chinese e-commerce giant Tencent Holdings Ltd had acquired a 5% stake in the BNPL company.

At the time, Afterpay was still in recovery mode from the COVID crash, with investors still nervous that a recession-induced wave of defaults may have been coming the company's way. But this vote of confidence from Tencent seemed to dispel these doubts and really lit a rocket under the Afterpay share price. Over the next month, investors would send Afterpay shares from around $30 to over $50. That's a rough 70% jump.

The company hasn't looked back since. The Afterpay share price continued to climb, topping out at a record $160.05 a share by February 2021.

Since February, Afterpay shares had slowly started to sink back towards $100 a share, and even sank below $90 at one point back in May. However, the Square deals emergence has once again resulted in a re-rating of Afterpay's value.

And that brings us to today.

So what lies in store for the Afterpay share price going forward?

Well, as long as this deal is in play, Afterpay's share price looks set to be tied to that of Square. But that won't mean that Afterpay won't still be one of the most watched ASX 200 shares until the day its stock leaves the ASX boards. If or when that does happen, ASX investors will still be able to indirectly buy Afterpay through Square's proposed ASX listing.

The Afterpay share price has gripped and excited ASX investors for years now. If Afterpay's independence finally comes to an end, it will be the end of an ASX era.