This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

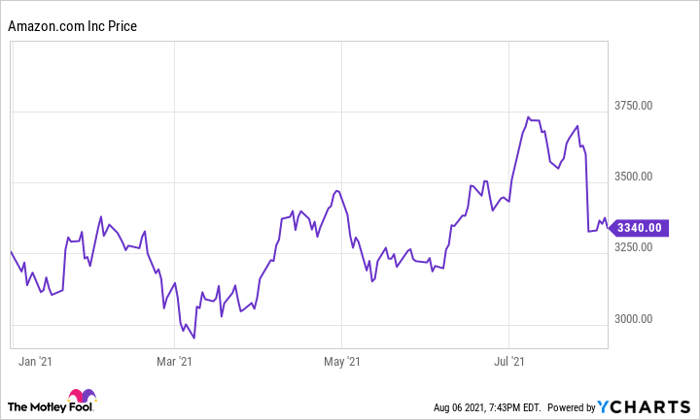

Just a few weeks ago, shares of Amazon.com (NASDAQ: AMZN) touched a new all-time high above $3,700. This pushed the retail and technology giant's fully diluted market cap to just shy of $2 trillion.

However, Amazon stock pulled back 8% after its late-July earnings report, as second-quarter revenue fell short of the analyst consensus and the company issued a weaker-than-expected forecast for the third quarter. While Amazon continues to produce very strong results by ordinary standards, these disappointments suggest that investors may have unrealistic expectations for the e-commerce titan.

Amazon.com stock performance, data by YCharts.

Failing to meet high expectations

Amazon generated $113.1 billion of revenue last quarter: up 27% year over year. Holding currency exchange rates constant, sales would have increased 24%. All three of Amazon's business segments posted solid gains. On a constant-currency basis, revenue rose 21% in the North America division, 26% in the international segment, and 37% for Amazon Web Services.

Most companies would love to achieve that kind of growth under any circumstances. Still, analysts had (on average) expected revenue to come in $2 billion higher.

Interestingly, Amazon's growth rate in North America trailed the broader retail industry. U.S. retail sales surged 27.8% year over year last quarter, as consumers flocked back to stores as the COVID-19 pandemic eased. Moreover, Amazon's Q2 revenue benefited from Prime Day shifting into June this year. The two-day event brought in about $7.5 billion of revenue, according to estimates from Piper Sandler analysts. (For comparison, Amazon's retail business has been generating about $1 billion of revenue on a typical day recently.)

Operating income jumped 32% year over year to $7.7 billion: near the top of Amazon's $4.5 billion to $8 billion guidance range. Nevertheless, this probably missed many investors' expectations, as the company often beats the high end of its operating income guidance by a wide margin.

More of the same ahead

Amazon's third-quarter forecast also disappointed many investors. The company projects that revenue will increase 10% to 16% year over year to a range of $106 billion to $112 billion. Meanwhile, Amazon estimates that operating income will decline from $6.2 billion a year ago to between $2.5 billion and $6 billion. The analyst consensus had called for revenue of $118.7 billion and operating income of $8.1 billion.

With Prime Day falling in the second quarter this year, investors had to be prepared for slower growth in the third quarter. Furthermore, Amazon faces tough year-over-year comparisons after revenue surged 37% in Q3 2020.

That said, it also appears that many consumers -- particularly in the U.S. -- have started to return to their pre-pandemic shopping habits due to the widespread availability of COVID-19 vaccines. During Amazon's earnings call, CFO Brian Olsavsky noted that growth had slowed to a mid-teens pace beginning in mid-May, excluding the impact of the Prime Day calendar shift.

Why investors should expect slowing growth

Prior to the COVID-19 pandemic, Amazon's growth rate had already started to moderate. On a constant-currency basis, revenue rose 22% in 2019, down from 30% in 2018 and 31% in 2017.

The pandemic drove a huge increase in e-commerce sales, reversing this trend of slowing growth. As a result, Amazon posted a 37% revenue gain in constant currency last year. However, to some extent, this just pulled forward growth that would have come in 2021 and future years. That has led to the sharp deceleration Amazon is experiencing now -- and which will likely continue in the near term.

Indeed, while Amazon's growth rate for 2020 and 2021 combined looks quite strong, U.S. retail sales have grown at an incredible pace over this period. As the tailwind from stimulus checks and reduced spending on experiences (like travel and dining out) fades, it will pressure Amazon's top-line growth. Additionally, Amazon has already crushed most of its weak competitors, which will make it harder to gain market share in the future.

Amazon stock could still potentially be a worthwhile long-term investment depending on the company's ability to expand its profit margin. However, investors will need to recalibrate their expectations for top-line growth. The low- to mid-teens growth Amazon is projecting for the third quarter could prove to be the new normal over the next several years.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.