The AGL Energy Limited (ASX: AGL) share price has underperformed the broad index over the past 5 years.

Whereas the S&P/ASX 200 Index (ASX: XJO) has posted a 5-year return of approximately 35%, AGL shares are 65% in the red over this time.

However, the AGL dividend might provide some reprieve to the situation here.

Dividend payouts can provide some 'downside coverage' on shares exhibiting less than favourable performances on the charts.

Here, we examine if this has been the case with the AGL share price over the past 5 years.

Exhibit 1. AGL Energy Share Price vs. S&P/ASX 200 Index: 5-year Return Comparison

Source: Google Finance

A bit of history on the AGL dividend

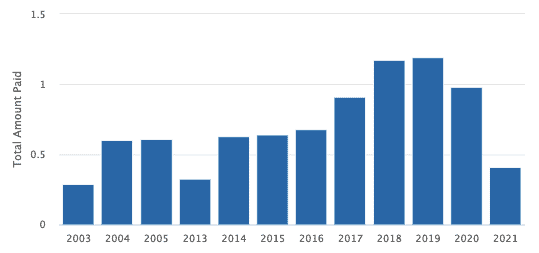

AGL has an extensive history of returning cash to its shareholders since September 2003.

The AGL dividend was suspended from March 2005 to September 2013. It then resumed, and the company has since continued to deliver two payments each year to date.

AGL paid its most recent dividend on 26 March at 41 cents, a small down-step from previous payments.

From March 2020 to March 2021, AGL paid total dividends of $1.39 per share. From March 2015 to March 2021, AGL dividends totalled $5.98 per share.

Just taking the periods from 2003 to 2021, without factoring in any fluctuations, AGL has expanded its dividend by a compound annual growth rate (CAGR) of only 1.94%.

Excluding the down-step in 2021, AGL dividend growth was at a CAGR of 7.2% to August 2020.

Exhibit 2. AGL Dividend History 2003 – 2021 (current).

Source: The Motley Fool Australia

Have the AGL dividends paid off for shareholders over the past 5 years?

To answer this question, we will exclude assumptions and calculations around AGL's dividend yield, for purposes of simplicity.

So, even when factoring in the AGL dividend, the share price has delivered a total loss of 35% over the past 5 years.

We can see the dividend has dampened the overall loss, but has not meaningfully changed the situation for AGL shareholders.

That means a $1,000 investment in AGL shares on 1 March 2015 would now be worth a paltry $650, given this 35% loss.

Here's another way to look at it. If we purchased 1,000 AGL shares on 1 March 2015 – what would our position be worth today?

Purchasing 1,000 shares on 1 March 2015 would have cost $15,050 on a closing share price of $15.05. Over this time, we would have received a total of $5,980 in dividends.

Including AGL's dividends, if we sell those same 1,000 shares today (at $7.20 per share), we incur a loss of 'only' 12.4%. But taking dividend payouts out of the equation, the loss balloons to 52%.

Let's tweak things a bit to examine further

Interestingly, some fascinating changes occur if we make some basic assumptions.

Let's assume we reinvested each of the dividend payouts (per share) we received into more AGL shares over this 5-year time frame. This is a common choice for many long term investors.

Adjusting for this dividend reinvestment plan (DRP), our loss actually expands to 28% in the red!

Logically, this makes sense, as we are purchasing more shares exhibiting a loss, thereby compounding our own losses. A vicious cycle of sorts.

Hence, this begs the question – have the dividends paid off for AGL shareholders?

Given the calculus displayed above, it stands to reason that AGL shareholders have benefitted somewhat from its dividend program.

We see that the AGL dividend has indeed provided some downside coverage, although it has not completely changed the narrative in terms of investors' total return characteristics.

Regardless, AGL shareholders have still endured a loss on their initial investment, if they bought the shares 5 years ago and held them until today.

Foolish takeaway

The AGL dividend program has not been enough to overcome its share price underperformance.

However, it has provided investors with some balance by dampening the overall capital losses and contributing to the return profile.

This is one benefit dividends provide to investors, aside from the obvious cash payment into one's bank account.

However, one must also consider the different scenarios that might occur, depending on decisions regarding the dividends received.

As in any investment case, due diligence is paramount.