The Santos Ltd (ASX: STO) share price is slipping during early afternoon trade despite announcing strong drilling results.

At the time of writing, the oil and gas producer's shares are down 0.61% to $6.51.

What did Santos update the ASX with?

Investors appear unfazed by the company's latest announcement coming from the Bayu-Undan Joint Venture, sending Santos shares lower. The company owns a 43.4% majority stake in the project, with the remaining interest held by 5 other minority parties.

According to its release, Santos advised production from the Phase 3C infill drilling campaign has commenced at the Bayu-Undan field.

The first well being brought online yielded better than expected results. The company recorded 178 million standard cubic feet per day (mmscfd) of gas and 11,350 barrels per day (bbl/d) of liquids. This significantly increases the liquids production per day at the Bayu-Undan field with over 25,000 bbl/d. In addition, offshore well capacity has also expanded for the supply of gas to the Darwin LNG plant.

Santos stated that the Noble Tom Prosser jack-up rig has now begun drilling on the second of the three wells. The program is expected to be completed sometime early next year, with results to follow.

Management commentary

Santos managing director and CEO, Kevin Gallagher commented on the outcome:

We are delighted to see first production from the 3C program, which is immediately delivering value to both the Bayu-Undan Joint Venture and the people of Timor-Leste and importantly helps extend the life of Bayu-Undan and the jobs and investment that rely on it.

We've seen a better-than-expected reservoir outcome with this first well of the campaign, with successful results across both the primary and secondary targets in the well and a much higher initial gas production rate than expected.

Timor-Leste regulator, Autoridade Nacional do Petróleo e Minerais (ANPM) president, Florentino Soares Ferreira added:

From the outset, the Phase 3C program has been seen as an opportunity to maximise the ultimate recovery in the Bayu-Undan field. This was of course a calculated decision from the regulatory side considering we are working under the Production Sharing Agreement regime in which the cost recovery scheme is a fundamental element in our assessment.

Santos share price summary

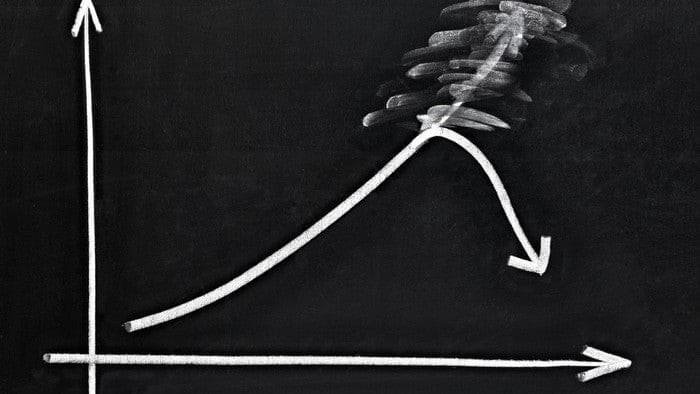

The Santos share price has gained almost 20% in the past year and is up around 3% year-to-date. The company's shares hit a 52-week high of $7.84 last month, but have headed lower ever since.

Santos has a market capitalisation of about $13.5 billion, with a tad more than 2 billion shares outstanding.