AMP Ltd (ASX: AMP) shares appear to be under the pump right now. Shares in the Aussie financial services group are down 30.1% year-to-date and 81.2% in the last 5 years.

But if there is one thing investors love, it's dividends. On October 1 2020, AMP paid a A$0.10 per share fully franked dividend. That was a special dividend after the sale of AMP Life in June 2020 for A$3 billion. In the group's March 2021 update, however, the board resolved to not declare a final full-year 2020 dividend.

That has left many wondering what AMP shares will be paying out to investors this time around.

How do AMP shares compare to the financial sector on dividends?

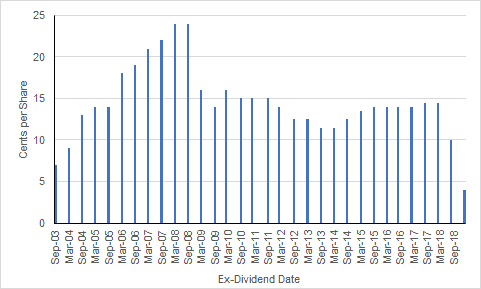

At present, the Motley Fool website is tracking AMP shares' dividend at $0.14 per share, franked to 90%. Given the financial services group's recent struggles, that is based on the most recent interim and final dividends available. As the figure below shows, AMP's dividend has been in decline in recent years.

AMP dividend payments by year

Using $0.14 per share as the basis for analysis, AMP would currently have a dividend yield of 3.07%. So, how does that stack up against other financial services shares on the ASX?

An obvious comparison would be the Aussie banks. The major banks' dividend yields as of 26 July 2021 are listed in the table below:

| Company | Dividend Yield as of 26 July 2021 |

|---|---|

| Commonwealth Bank of Australia (ASX: CBA) | 2.50% |

| Westpac Banking Corp (ASX: WBC) | 3.60% |

| National Australia Bank Ltd. (ASX: NAB) | 3.46% |

| Australia and New Zealand Banking Group Limited (ASX: ANZ) | 3.79% |

| Macquarie Group Ltd (ASX: MQG) | 2.98% |

| Group Average | 3.27% |

| Company | Dividend Yield as of 26 July 2021 |

| Commonwealth Bank of Australia (ASX: CBA) | 2.50% |

| Westpac Banking Corp (ASX: WBC) | 3.60% |

| National Australia Bank Ltd. (ASX: NAB) | 3.46% |

| Australia and New Zealand Banking Group Limited (ASX: ANZ) | 3.79% |

| Macquarie Group Ltd (ASX: MQG) | 2.98% |

| Group Average | 3.27% |

Source: Google Finance. Table: author's own

It's clear that the major banks (including Macquarie) have dividend yields between 2.50% and 3.79%. That would mean a 3.07% dividend yield on AMP shares wouldn't be too far away from par for the course in the Financials sector.

However, the big if here is whether or not AMP will declare a dividend for 2021. That is far from a certainty given the significant change being undergone and a restructure of the broader AMP umbrella group of businesses.

If AMP could manage a $0.14 per share full-year dividend, that 3.07% dividend yield looks to be roughly in line with many of the large financial services institutions. However, at present, there's no guarantee of any payment from the Aussie wealth group.

Foolish takeaway

AMP shares have been under pressure for quite some time. Scandals, leadership changes and the 2018 Financial Services Royal Commission have combined to create a challenging environment for the Aussie wealth group.

Investors will be waiting to see what dividend, if any, will be declared by the board. That will then provide a better idea of how AMP measures up against many of its Financials sector peers on the ASX.