This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

What happened

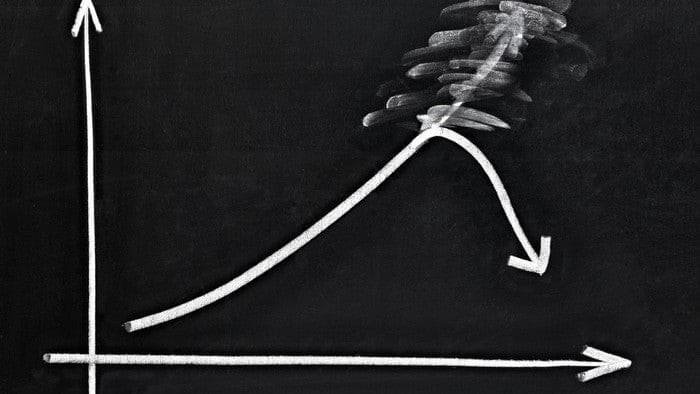

After racing upward by more than 4% in Monday trading, Tesla (NASDAQ: TSLA) give back half of its stock price gains Tuesday. As of 2:52 p.m. EDT, shares of the electric car manufacturer were down by 2.5% from Monday's close.So what

So what was troubling Tesla on Tuesday? Well, for one thing, there's the ongoing trial questioning the propriety of its $2.6 billion acquisition of SolarCity in 2016. Plaintiffs in the case allege that CEO Elon Musk put his own financial interests ahead of those of Tesla's shareholders. That's obviously not a good look for the company. Meanwhile, Wall Street is still digesting the import of recent pricing moves, and of Tesla's weekend rollout of "FSD v.9.0 Beta," the latest iteration of the software that's supposed to help make Tesla cars autonomous and usher in an age of robo-taxis. In a note it put out Tuesday morning, Goldman Sachs asserted that increased sales and higher prices on Teslas sold will help the company earn an above-consensus $5 a share in 2021. On the other hand, notes TheFly.com, Goldman does worry that chip shortages in the automotive industry could curtail Tesla's production numbers this quarter. If Tesla isn't able to sell as many higher-priced Model S and Model X cars as Wall Street expects, that could weigh on profits.Now what

Rumors of a price hike on the FSD feature (which some speculate could rise from $10,000 currently to $14,000) could help boost Tesla's profits, of course. On the other hand, in a note released Monday, analysts at Citigroup warned that as far as autonomous driving goes, the new FSD software "doesn't appear very different than" the software that preceded it, and certainly falls short of the level of independence that would permit transforming Teslas into robo-taxis, as Musk has predicted. In short, even with share prices down 24% from their highs earlier this year, Citi sees Tesla stock as overpriced. Unlike Goldman Sachs, which thinks Tesla is a "buy," Citi still argues it's a "sell" -- and worth no more than $175 a share.This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.