The Coronado Global Resources Inc (ASX: CRN) share price remains frozen today after the company released its equity offer presentation to investors. The coal producer is seeking $100 million in refinancing funds.

Coronado shares have been paused at $60 cents since the company entered a trading halt on 29 April, after falling more than 33% the past month.

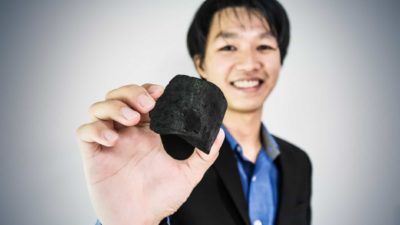

Coronado produces high-quality metallurgical coal, an essential element in the production of steel. The company owns a portfolio of operating mines and development projects in Queensland and also holds interests in Virginia and West Virginia in the United States.

What Coronado's refinancing means

Coronado's coal mining operations have been hit – along with all other coal producers – by the ramp-up in renewable energy focus in 2021 by governments across the world.

The company's Queensland operations were also impacted by China's ban on Australian coal exports, although as an international company, it was better suited to weather those hits.

The company has today included a US$100 million equity transaction as part of its proposed refinancing package, which will exist as a multi-currency asset-based loan.

This is part of a broader proposed US$550 million refinancing package that the company expects, when completed, will create a capital structure that is "flexible through market cycles with… specific benefits to Coronado stakeholders".

In the company's words, it hopes to use the cash to create "increased financial flexibility, an extended maturity profile; diversified funding sources; and the maintenance of liquidity for the business and a reduced net debt level".

Coronado management comments

Coronado CEO Gerry Spindler said the refinancing was good news for the embattled company.

We are very pleased with the support we have received from investors across the globe after what has been a very difficult period for producers in the metallurgical coal sector.

This refinancing package will leave Coronado very well placed to deliver value to stakeholders as the global economy continues to recover following the COVID-19 pandemic and the demand for steel-making coal continues to improve.

Coronado share price snapshot

The Coronado share price is down across every time metric, losing 6% over the past week, 33% the past month, 47% in 2021 so far and over the past 12 months, while it's also down more than 90% against the basic materials sector.