ASX lithium shares have had a good month. Market leaders like Orocobre Ltd (ASX: ORE) have seen their valuations surge as investors clamber to get their hands on company shares.

So, what's driving the latest lithium share price surge on the Aussie share market?

Why ASX lithium shares surged in April

Resources shares of any kind are always going to be tied to the underlying commodity price. If global commodity prices are weak, it's tough to boost sales revenue given supply-demand factors need to be evaluated.

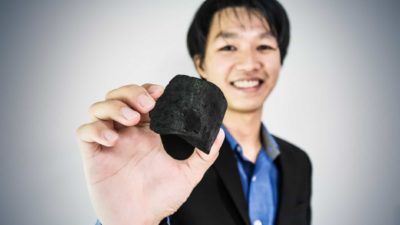

It's no different for ASX lithium shares. Supply disruptions in Chile have created strong market conditions for Aussie producers and April saw a lithium price surge. This helped push the valuations of Orocobre, Pilbara Minerals Ltd (ASX: PLS) and Galaxy Resources Ltd (ASX: GXY) up.

The Orocobre share price climbed 42.5% in April while Pilbara and Galaxy shares surged 10.5% and 54.6%, respectively. Pilbara shares struggled to keep pace after port delays left the company's final March shipment partially completed. Pilbara's March quarter spodumene concentrate shipments were broadly flat at 71,229 dry metric tonnes.

Data from battery supply chain research and price reporting agency Benchmark Mineral Intelligence showed strong lithium price gains. In fact, the lithium carbonate CIF Asia price rose 11.1% in March with spodumene (6%) prices up 17.4% for the month. The price jump to US$10,000 per tonne represents the biggest monthly increase since January when the price discovery began.

Strong electric vehicle and broader auto sales have helped push demand levels up in early 2021. That demand rally has coincided with strong gains for ASX lithium shares like Orocobre.

Global ratings agency S&P Global noted there are signs prices are nearing a peak, however, with an improving supply outlook. That means shares in the likes of Galaxy and Orocobre could be worth watching in May.

Foolish takeaway

ASX lithium shares have rocketed higher to start the year. All three of Galaxy, Orocobre and Pilbara Minerals are currently outperforming the S&P/ASX 200 Index (ASX: XJO) with double-digit gains in March.

Strong pricing conditions have helped propel these valuations higher despite signs of improving supply conditions in the global market.