The Grange Resources Limited (ASX:GRR) share price is rising today after the company released its quarterly activities report, outlining increased production and sale prices.

At the time of writing, the Grange Resources share price is up 5% to 63 cents per share.

Grange Resources is an Australian-based international iron-ore miner that also has a side hustle in building real estate.

It's primarily engaged in the exploration, evaluation, and development of mineral resources and iron ore mining operations. Grange Resources' projects include the Southdown Magnetite and associated Pellet Plant Projects.

The group has two reportable segments. Firstly, the exploration, evaluation, and development of mineral resources and iron ore mining operations. Secondly, the development and construction of housing units.

The company generates the majority of the revenue from the sales of iron ore products in China. Followed by Japan, Australia, and Korea.

Grange Resources' recent results

The Grange Resources share price is responding to mixed but ultimately positive results in the company's last quarter. Its pellet production increased for the quarter with 616 kilotonnes, compared to 479 kilotonnes for the December quarter. This is due to the company's pre-planned major shutdown for the installation of a steel pan conveyor in the previous quarter.

Pellet sales decreased for the quarter to 556 kilotonnes, compared with 754 kilotonnes for the December quarter. However, there was an increase in average received prices for the quarter to $297.66 per tonne. This is was up compared with $236.77 per tonne for the December quarter.

Grange Resources' unit cash operating cost also increased for the quarter to $113.11 per tonne. Compared with $101.13 per tonne for the December quarter. It has cash and liquid investments of $258.64 million and trade receivables of $73.38 million compared with cash and liquid investments of $202.93 million. Additionally, the company has trade receivables of $79.32 million for the December quarter.

The company has spent outlays of approximately $11.5 million in the quarter on capital projects. These are mainly focused on plant and processing equipment.

Grange Resources management

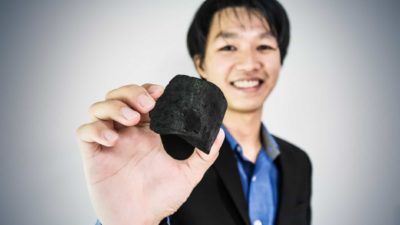

Grange Resources CEO Honglin Zhao was pleased with the company's results.

The efforts of the Team have been supported by very strong prices in the market, resulting in a strong first quarter of 2021. The Team continues to focus on optimising the life-of-mine plan at Savage River and assessing the strategic and technical studies of its open pit, underground, and Southdown projects.

Grange Resources share price snapshot

The Grange Resources share price has more than doubled since December 2020, and is currently trading 10% higher than a week ago, 27% higher in the past month, and 202% higher than 12 months ago.