The PayGroup Ltd (ASX: PYG) share price edged higher today before ending the day down. Today's price oscillation comes after the company announced a new acquisition and updated earnings guidance. Today's announcement ended the trading halt the company had been in since yesterday.

At close of trade today, the PayGroup share price was at 62.5 cents – 0.79% lower. For comparison the S&P/ASX All Ordinaries Index (ASX: XAO) finished the day up 0.68%.

What did PayGroup announce to the ASX today?

In a statement to the ASX, the business software gave several announcements regarding its business. These were:

- An upgraded earnings guidance for FY21.

- A strategic acquisition.

- Confirmation of commitments to raise $15 million via an institutional placement, and

- A share purchase plan offer to eligible shareholders to raise $1 million.

FY21 earnings guidance

PayGroup has announced a further revision of its earnings guidance for FY21, just over two weeks from its first guidance update for FY21. In today's announcement, the company said it expects annualised recurring revenue (ARR) for the financial year to equal $21.5 million. That's $1 million above the last guidance.

Furthermore, the company said it expects the value of new contracts signed this financial year to total $13 million. This is $3 million above the last guidance.

Strategic acquisition

In its second announcement today, the company advised it would purchase 100% of Integrated Workforce Solutions (IWS).

IWS is a workforce management software platform "specialising in solutions for the franchise sector in Australia and New Zealand." IWS already has 1,000 customers and processes 400,000 payslips a year. PayGroup says the platform has a customer retention rate of 94%.

The total cost of the purchase to PayGroup is $15.3 million. The payment compromises a $12.75 million initial consideration ($8.4 million of which is payable in cash and the rest in PayGroup equity). The company will pay the remainder of the fee if key revenue and profit targets are met during FY22 and FY23.

PayGroup expects the acquisition to make "a material contribution" to the company's growth going forward due to increased ARR and gross margins. This should bode well for the PayGroup share price.

$15 million institutional placement

PayGroup claims in today's statement it has "secured firm commitments from new and existing investors" to raise $15 million before costs. 26.8 million shares will be issued at price of 56 cents each, which represents an 11.1% discount on the previous trading day's close.

$1 million share purchase plan

Existing, eligible shareholders in the company will be able to purchase up to $30,000 worth of new shares each under a plan to raise approximately $1 million. To be an eligible shareholder, an investor must reside in Australia or New Zealand and have held shares in the company as of 7:00pm on 30 March 2021.

The new shares will be sold at a price of 56 cents each.

PayGroup share price snapshot

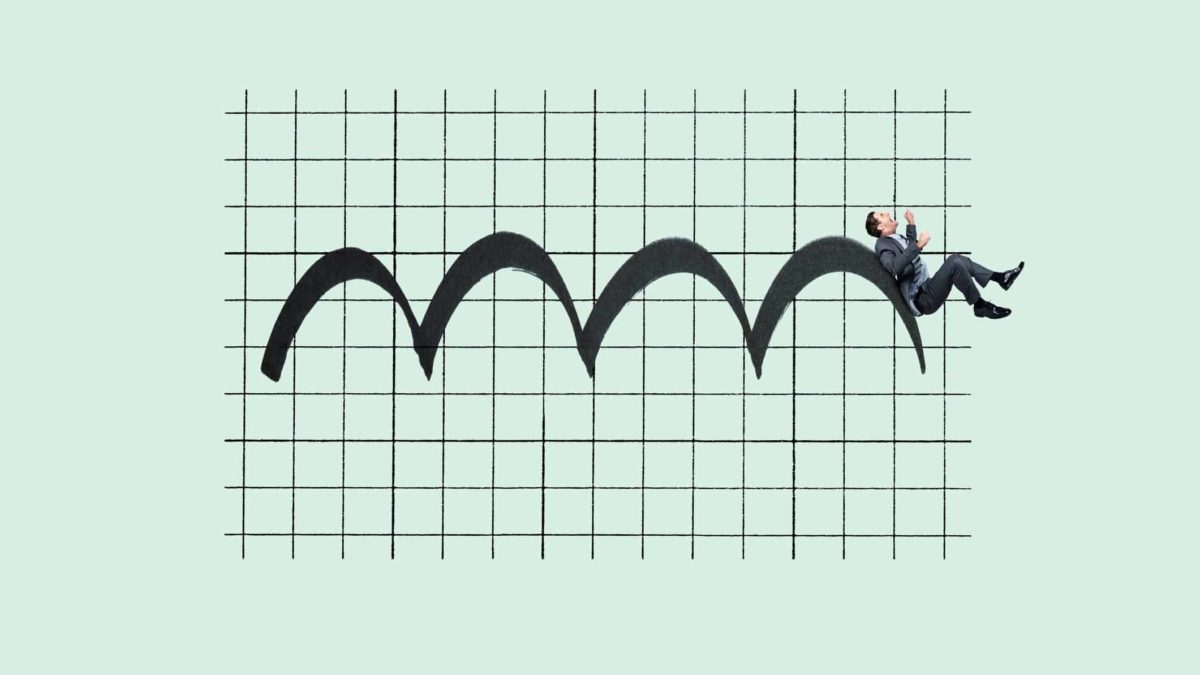

Over the last 12 months, the PayGroup share price has increased a modest 7.76%. In June 2020, the PayGroup share price hit a 52-week record of 90.5 cents. Since then, the value of the company has dropped by 30.94%.

At today's market price, PayGroup has a market capitalisation of $51.6 million.