The AMP Ltd (ASX: AMP) share price crashed yesterday and has rebounded today on intense speculation surrounding the future of the company's CEO, Francesco De Ferrari. Trading in the company's shares was paused just before 4 pm yesterday before resuming trading this morning.

AMP shares finished Thursday at $1.335 – down 3.61%. By comparison, the S&P/ASX 200 Index (ASX: XJO) finished the day 0.17% higher. However, today the AMP share price is up 0.75% to $1.345.

Is AMP CEO Francesco De Ferrari resigning?

The AMP share price has been on a wild ride. News of Mr De Ferrari's possible departure was first broken by the Australian Financial Review (AFR) yesterday. The newspaper then claimed to have confirmed the news this morning.

However, AMP released two short statements on the rumours. Yesterday, the company said:

AMP Limited notes the media reports today and confirms that Francesco De Ferrari remains as Chief Executive Officer of the group.

Today, the company stated:

AMP confirms there has been no change to the CEO's position and that Mr De Ferrari has not resigned. The Board and Mr De Ferrari are working together and constructively discussing the future strategy and leadership of the group, post the completion of AMP's portfolio review. These discussions are ongoing, and AMP will provide updates as required.

Neither statement gave any clear indication as to Mr De Ferrari's position going forward, only that he had not resigned.

De Ferrari's history with AMP

De Ferrari, who took the helm of the beleaguered company in December 2018, has seen a precipitous fall in the company's value during his tenure. The former Credit Suisse banker became CEO in the wake of the devasting Banking Royal Commission, which found AMP had lied to regulators and charged clients for services it did not deliver.

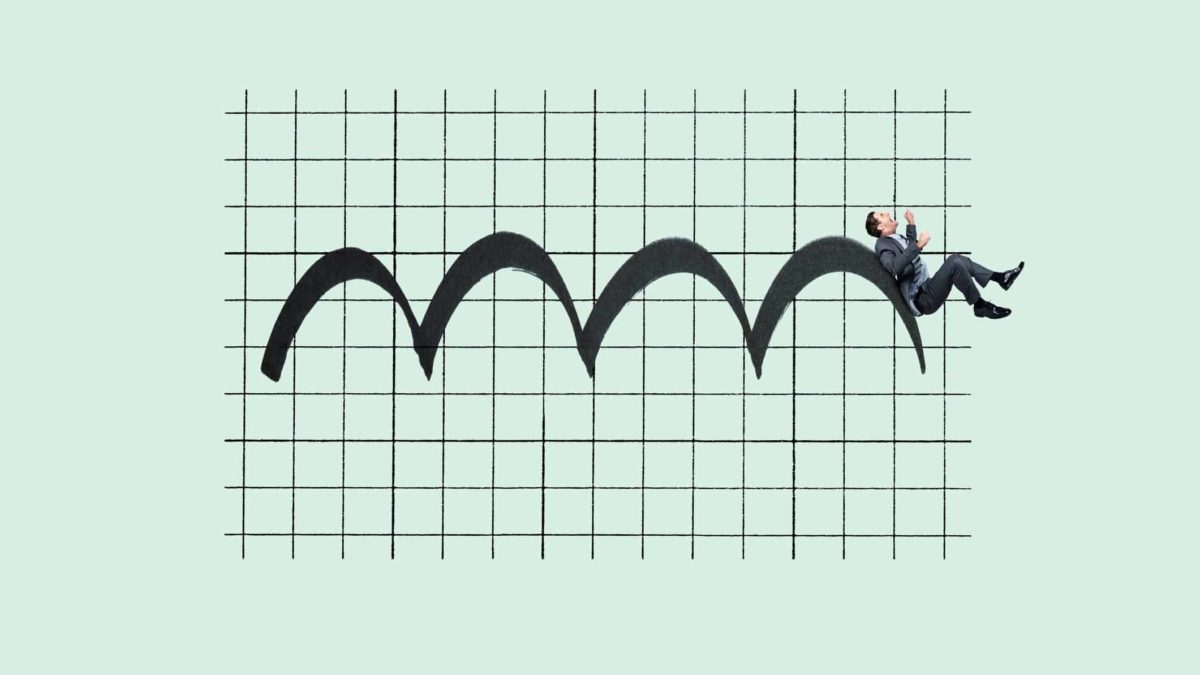

The AMP share price has fallen by more than 45% in the 2¼ years De Ferrari has been in charge. Scandal has not evaded the company during his reign either.

The man who would likely replace De Ferrari on an interim basis, were he to in fact step down, is Scott Hartley, according to the AFR. Hartley's immediate predecessor as CEO of group subsidiary AMP Australia, Alex Wade, was forced to resign after sending explicit photos to a subordinate.

The former CEO of another subsidiary, AMP Capital, Boe Pahari, was also forced out soon after, along with group chair David Murray and AMP Capital chair John Fraser, after it was revealed he was promoted despite facing similar sexual harassment complaints. Pahari was paid a $1 million bonus despite only holding the job for 53 days and resigning in disgrace. Parts of AMP Capital are now subject to a takeover by Ares Management Corp (NYSE: ARES).

In its full-year report for FY20, AMP reported net profits for the group fell by 33% on the previous year to total $295 million. Total assets under management (AUM) were $255 billion. That was 6% lower than FY19 and the resulting revenue from the AUM was 10.5% lower ($10.5 billion total).

AMP share price snapshot

While investors have been leaving in droves during De Ferrari's tenure at AMP, many seem to fear further upheaval if and when he goes even more.

As mentioned, many had been offloading their shares on the news he was to resign, only to buy back in once no decision was made. Over the long term, however, the company has been in decline. Yet if an investor bought AMP shares 12 months ago today, they would be sitting on an 8.5% return on investment.

It should be noted, however, that one year ago was the midst of the brutal coronavirus market crash.

AMP has a market capitalisation of $4.6 billion.