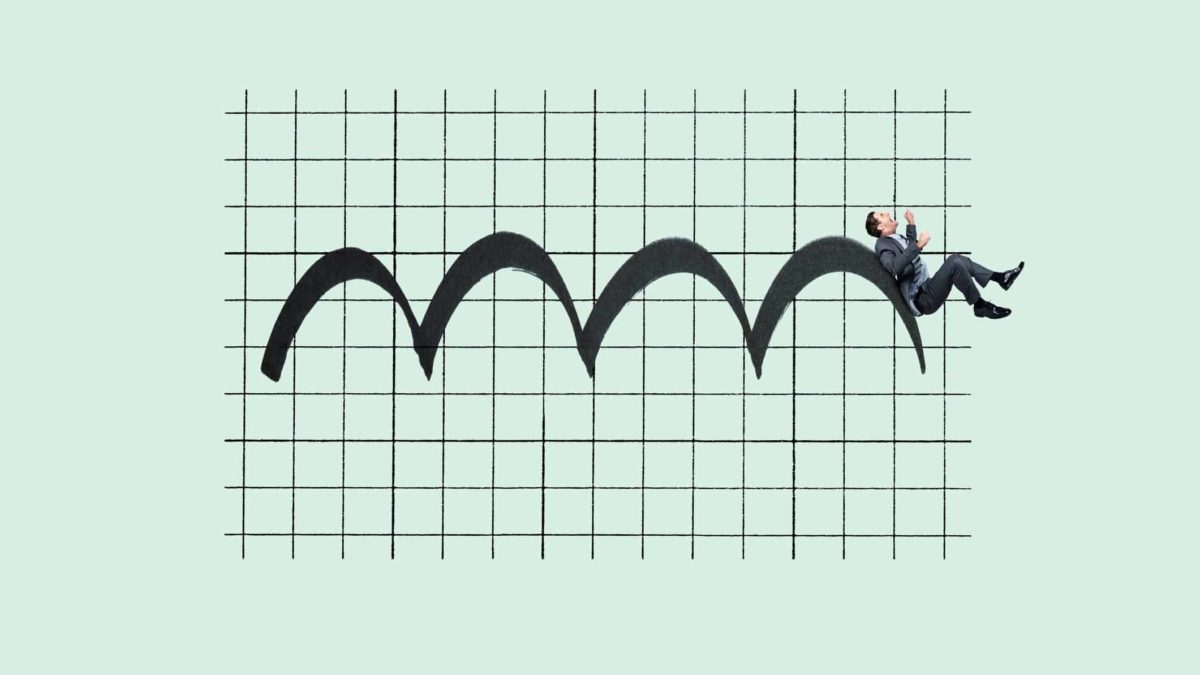

The Euro Manganese Inc CDI (ASX: EMN) share price has been volatile so far this week. Shares in the Canadian group roared back to life on Tuesday, closing 7.8% despite slumping lower in Monday's trade.

At the time of writing, the Euro Manganese share price is down 4.35%, trading at 66 cents.

Why is the Euro Manganese share price falling?

Euro Manganese is a Canadian small-cap battery materials company listed on the ASX. The group specialises in the extraction and development of high-grade manganese for use in electric vehicle (EV) batteries. The company is advancing its Chvaletice Manganese Project in the Czech Republic as a key strategic initiative.

Shares in the Canadian mining group slumped lower 4.5% lower on Monday after the company announced a A$30.0 million private placement to the market. Strong institutional participation across the book helped to make the placement oversubscribed.

The proceeds from the $0.60 per CDI offer will help advance its Chvaletice Manganese Project. Euro Manganese intends to produce battery-grade manganese by reprocessing a large deposit of manganese carbonate, contained in waste from historical mining operations at the site.

The Euro Manganese share price crashed lower on Monday after the oversubscribed placement. A strategic investor and environment, sustainability and governance (ESG) focused fund underpinned the capital raise.

However, it hasn't been all bad news for shareholders. The Euro Manganese share price pared back its losses on Tuesday, surging 7.8% higher to close at $0.69 per share.

Euro Manganese raised the A$30.0 million in funds across two tranches. Euro Manganese maximised its A$25 million under Listing Rule 7.1 in the first tranche. The second tranche of $5.0 million, in excess of Listing Rule 7.1, will be subject to shareholder approval to be sought at a special meeting in May 2021.

Euro Manganese currently has a market capitalisation of $134 million.

Foolish takeaway

The Euro Manganese share price fell 4.5% lower on Monday after its latest capital raise announcement. The volatility continued on Tuesday with shares in the battery materials group surging 7.8% higher to $0.69 per share at yesterday's close.

Shares in the Canadian battery materials group are trading lower again today following two large share price swings in the last two days.