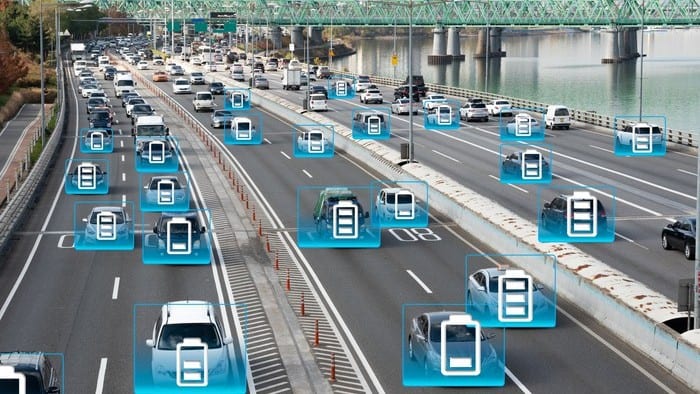

S&P/ASX 200 Index (ASX: XJO) copper shares will be among those to enjoy a healthy tailwind as the growth of global electric vehicle (EV) adoption picks up pace.

That's because copper, thanks to its high conductivity, is one of the key metals used in the batteries that give EVs their power. As EV numbers balloon, so too should the demand for copper.

Living in Australia, it's easy to overlook the reality that EVs are set to replace combustion engine vehicles over the next few decades. Australia, to date, has amongst the lowest levels of EVs on the road per capita of any developed nation.

Part of Aussies' reluctance to give up their good old petrol motors is range anxiety. It's a big country, and you don't want to have to be stopping every 200 kilometres for a lengthy recharge.

Another big hurdle, both in Australia and elsewhere, is the higher price tag EVs demand.

Many companies are busy working to provide longer battery life and more rapid charging technology. And now the price of EVs is plummeting in China.

EV sales to skyrocket

As Bloomberg reports, Chinese EV company Hozon Auto is selling cars that run on electric motors and batteries for US$10,000 (AU$13,000). And that hugely reduced price tag is likely to see a rapid uptake in the Middle Kingdom.

Bloomberg NEF analyst Siyi Mi says, "These ultracheap EVs are reaching a new customer in China, as they likely will in other markets as prices come down."

According the BNEF:

EV prices are on track to reach parity with fossil fuel-powered cars in the next four to six years, at which point annual sales will start to skyrocket, reaching 25 million in 2030, up from about 2 million a year currently.

And these super cheap EVs are already outpacing some Tesla Inc (NASDAQ: TSLA) sales numbers.

Bloomberg notes that:

In the month after the Hongguang Mini EV made its debut in July it was the top-selling new-energy vehicle in China, with 15,000 units sold. In September its sales hit more than 20,000, almost double that of Tesla Inc.'s Model 3 that month.

ASX 200 copper shares

Among the heavy hitters in Australian copper companies is ASX 200 copper share Oz Minerals Ltd (ASX: OZL), with a market cap of $7.2 billion.

At the current $21.43 per share, Oz Minerals shares are trading near 13 year highs. That milestone was first achieved on 18 February when the copper producer reported a 30% increase in net profit for the full 2020 financial year.

Over the past 12 months the Oz Minerals share price is up 190%. By comparison the ASX 200 has gained 27% in that same time.