Before the world had heard of the so-called Reddit army and WallStreetBets.

Before most any of us had a clue what GameStop Corp (NYSE: GME) did, let alone that the GameStop share price would be claiming global financial headlines for weeks running.

Before all of that, there was Robinhood.

That's the United States-based, commission-free investing app that soared in popularity during the long months of the pandemic lockdown. Millions of retail investors signed onto the service. Many invested in shares solely because they were moving higher.

Chasing the momentum higher, some day traders certainly made money. But many others will have lost money, buying into the big, new story too late, when share prices were due for a major retrace.

Two investment legends give Robinhood style day trading the thumbs down

Charlie Munger, Warren Buffett's long time business partner, cautioned investors about the nature of day trading. He compared it to gambling, specifically to punting on racehorses.

That critique was not well received. Robinhood itself tweeted, "To suggest that new investors have a 'mindset of racetrack bettors' is disappointing and elitist."

But Munger isn't the only investment guru concerned with the risks of short-term profit chasing. Richard Bernstein, founder of investment management firm Richard Bernstein Advisors, stepped into the debate himself.

As Bloomberg reports:

Munger's comments "were derided as those made by an old guy who does not understand today's more modern markets," Bernstein wrote, but stock market history backs up Munger's point about a short-term focus being harmful to one's wealth, particularly when chasing popular momentum stocks.

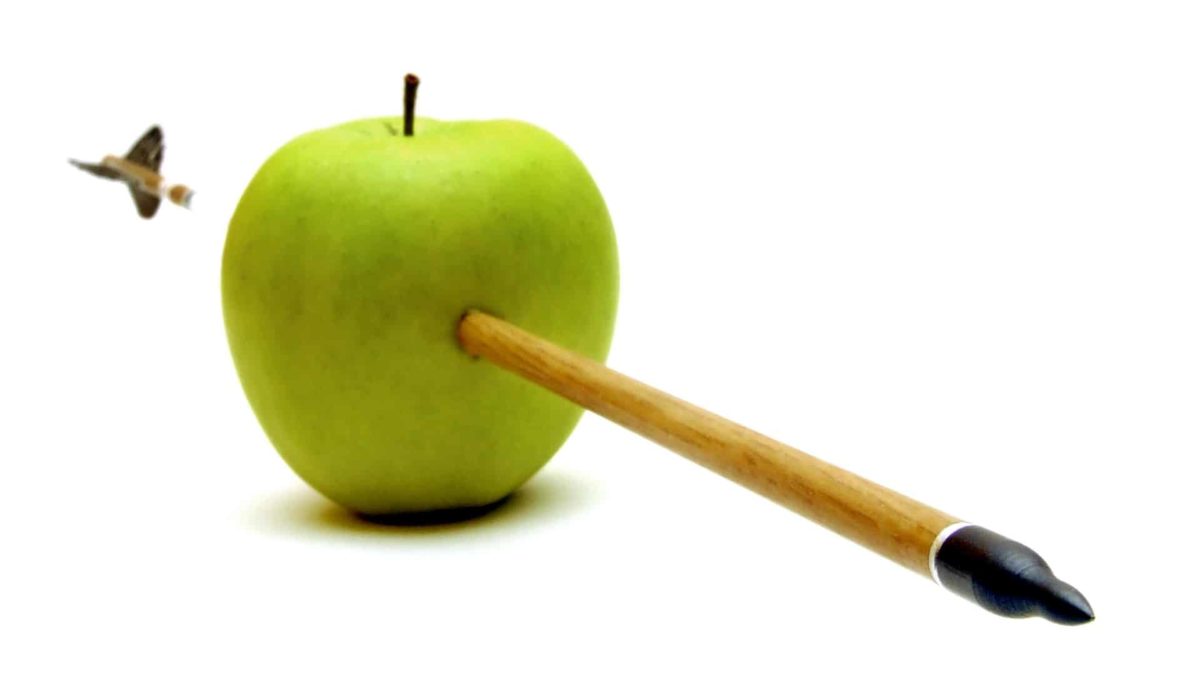

Day trading or coin flipping?

Bernstein backed up his warning with a chart showing that the probability of losing money on the S&P 500 Index (SP: .INX) – using rolling price returns from January 1930 to January 2021 – increases markedly the less time an investor holds onto their shares.

For those buying and selling in one day, there's a 46% chance of losing money. That drops down to 31% at 12 months and 10% for long-term investors holding on for 10 years.

Bernstein said:

The probability of success when day trading is only slightly better than when flipping a coin. There has historically been about a 54/46 chance of making money when holding stocks for a day versus 50/50 from coin flipping.