Last week blood products giant CSL Limited (ASX: CSL) unveiled a huge double-digit growth in sales and profit in its half-year results to 31 December 2021. The company also added over US$1.2 billion in cash and announced an increase to its interim dividend.

If you're considering buying CSL shares for their dividend potential, here are some important things to know.

What is CSL's dividend yield?

In its recent half-year results, CSL declared an interim dividend of US$1.04 per share for the six months to 31 December 2020. This was up 9.5% on the same corresponding period and, based on current exchange rates, suggests CSL has a trailing dividend yield of around 1.0%, unfranked.

When does CSL pay its dividend?

The CSL share price will go ex-dividend on Thursday 4 March 2021. The 'ex-date' is when the shares start selling without the value of their next dividend payment, so an investor needs to own the shares before the ex-date to receive the dividend. The dividend will then be paid on Thursday 1 April 2021.

What does the company's dividend history look like?

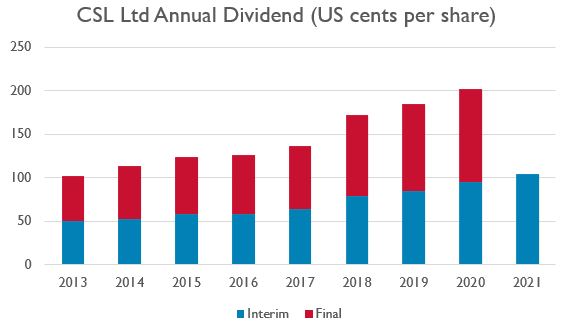

It's interesting to look at how CSL's dividend has performed over the last few years. In fact, as you can see from the chart below, CSL has an impressive track record of growth when it comes to paying annual cash dividends over the last eight and a half years:

Source: chart compiled by the author, data from CSL.

How much of its earnings does CSL payout?

Over the last 12 months, CSL has reported dividends totalling US$2.11 per share, while the company's reported earnings per share (EPS) over the same period were US$5.86. From this, we can see that CSL will be paying out about 36% of its earnings for the last 12 months. This might fluctuate more or less over time. For the full 2020 financial year, CSL actually paid out a slightly higher percentage of around 44% of earnings per share.

If a company is paying out more in dividends than it is earning, this could be a warning sign that the dividend may not be sustainable over the long term.