This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

GameStop Corp (NYSE: GME) stock is the recipient of an extraordinary amount of attention lately. It is caught up in the middle of a buying frenzy that started on the Reddit forum subgroup r/WallStreetBets. At one point, the price for one share of GameStop stock rose a jaw-dropping 1,063% just in January. That increase was fueled in part by some investors scrambling to cover shares they held short.

Although the reason for the excessive GameStop share purchases and sales is more related to some (potentially lucrative and potentially damaging) quirks of stock trading, fundamentally GameStop as a company does have one undeniable advantage that might make it a worthy stock to own longer-term.

Hardcore gaming enthusiasts are the key

GameStop is a video game retailer with over 5,000 locations in at least 10 countries. Having so many locations is not ideal when there also happens to be a major shift in the video game market to digital purchases underway. Further, next-gen gaming consoles are now out, and selling well, that allow for digital-only versions of games with the intent of persuading consumers to accelerate their shift to digital purchases. Manufacturers of video games prefer to sell them digitally as it reduces the costs of packaging and shipping the products to customers and it limits the resale of those games by the initial purchaser. That may partly explain why since 2019, GameStop has been forced to close over 800 brick-and-mortar locations, with plans to close 200 more.

However, some of the most enthusiastic gamers (the ones who play so many hours that they get bored of games quickly) would rather have a physical copy. Why? That's because when they are finished playing a game they can sell it, or trade with friends -- an option not available to them with a digital copy. Catering to this crowd, GameStop offers trade-ins and used games for purchase. This allows hardcore gamers an opportunity to recoup some of their purchase price for video games, and allows others the option to buy used games at prices discounted from the retail versions.

At the moment, digital games typically sell for the same retail price as their physical counterparts. For game enthusiasts, the physical copy is still the better option, and therein lies the undeniable advantage that GameStop currently has. Unless game manufacturers are willing to lower prices on digital versions or allow digital games to be used as trade-ins to purchase new games, GameStop will continue to be a destination for game enthusiasts.

What this could mean for investors

At the very least, this continued demand means that GameStop will not be made irrelevant anytime soon. This advantage is certainly not enough to grow sales, but it could be enough to buy GameStop management time to pivot its business model. After all, over the last decade revenue is only declining at a compounded annual rate of 3.3%, which is not catastrophic. Of course, 2020 revenue for the brick-and-mortar retailer was much worse because of temporary store closures required due to the pandemic, but the launch of new gaming consoles from Sony and Microsoft helped comparable store sales increase by 4.8% in the nine-week holiday period.

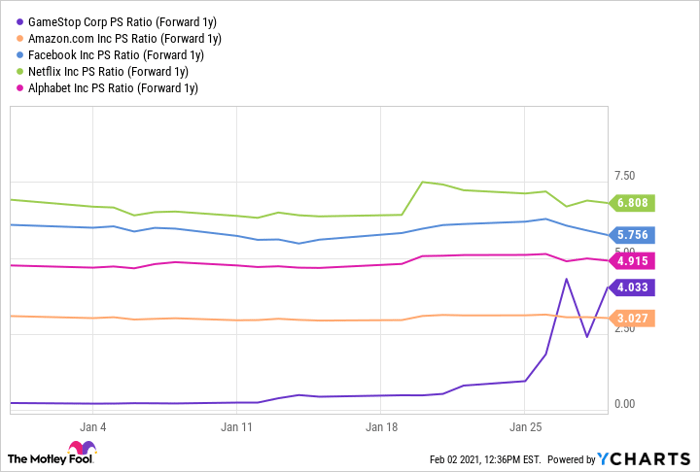

Data source: Ycharts.

Admittedly, this advantage may not be enough to justify its currently elevated stock price, which is trading at a price to sales ratio similar to that of several FAANG stocks (see chart above). In fact, it is trading at a higher forward P/S ratio than Amazon.

Unfortunately for GameStop shareholders, the stock is tumbling down from its per-share high of near $350 to $60 as of this writing. Investors wanting to make a prudent decision would be better off putting their money into more proven winners.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.