The ASX bull market is losing steam today but there are good reasons to believe that ASX shares can keep running higher through 2021, if not longer.

The S&P/ASX 200 Index (Index:^AXJO) shed 0.8% ahead of the market close and will likely finish at the bottom of its intraday trading range.

It's hard to feel confident about equities when many experts point to overstretched valuations, which leave little room for bad news.

And bad news can come from multiple fronts. A slower than expected roll out of mass COVID-19 vaccinations (essential for economic growth), mutating virus, rising bond yields and asset bubble fears are only a few that will keep investors on their toes.

Property rise will fuel ASX shares bull run

But there's good news. ASX share market bulls looking for reassurance can thank the property market.

Expectations of rising home prices bode well for share investors, according to Morgan Stanley.

Rising home prices a bullish signal for ASX shares

That might sound somewhat counter-intuitive to some who believe that more capital flows into property means less for ASX shares. Property investors always feel like adversaries to share investors despite widespread overlap of the two camps.

How property and share investors are linked

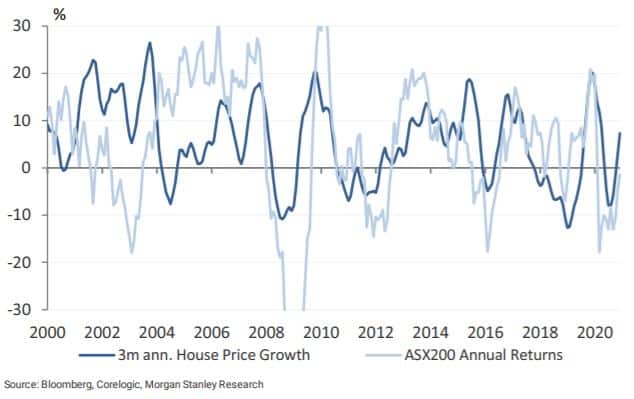

But history shows that property is the best friend of ASX shares, and for good reason.

"House prices are an important signal of equity returns, both through direct housing-linked stock exposure (including sizable banks sector)," said Morgan Stanley.

"And also the underlying uplift they provide to the economy, given the significant leverage of the household sector to housing (e.g. wealth effects, construction employment etc)."

Double-digit growth forecast

Experts believe that house prices could jump by up to 10% this calendar year, reported Domain Holdings Australia Ltd (ASX: DHG).

The prediction follows data that shows house prices and new loan commitments hitting record highs.

This bullish forecast for property bodes well for the shares. Record low interest rates are the gift that keeps on giving for ASX investors.

Foolish takeaway

The flood of cheap money first lifted shares from their COVID low in March. Now it's fuelling a hot property market.

This is one reason why I am bullish about the banking sector after years of being underweight on the sector.

The Commonwealth Bank of Australia (ASX: CBA) share price, Westpac Banking Corp (ASX: WBC) share price, Australia and New Zealand Banking GrpLtd (ASX: ANZ) and National Australia Bank Ltd. (ASX: NAB) share price have been outperforming recently too.

Buy the dip, fellow Fools!