This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Netflix Inc (NASDAQ: NFLX) shares touched an all-time high on Wednesday after the company delivered another impressive earnings report. It added 8.5 million subscribers in the period and said it would no longer need to take on debt.

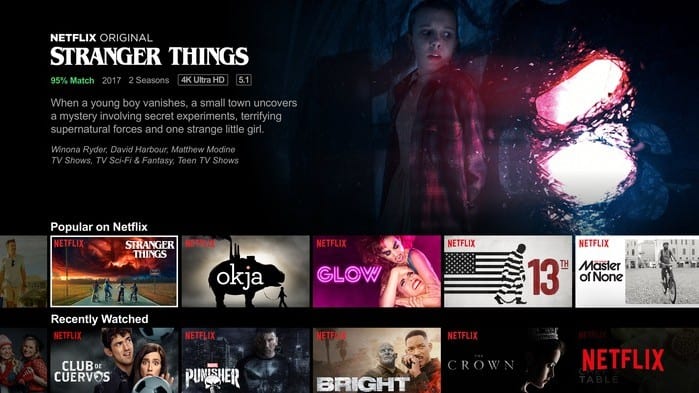

Despite record subscriber growth in 2020, which was aided by the coronavirus pandemic, Netflix bears continue to roar about the onslaught of competition the streamer is facing.

Over the last year or so, Disney+, Apple TV+, Peacock, HBOMax, and Discovery+ have all joined the streaming fray, and ViacomCBS's Paramount+ is set to launch in March.

Streaming clearly reached a tipping point last year and the coronavirus pandemic has only accelerated the transition from linear TV to streaming TV that co-CEO Reed Hastings predicted several years ago. For Netflix, the question of whether the company has a sustainable competitive advantage with all the new competition entering the streaming arena bears asking, but after the latest report, there are a number of clear signs that Netflix does have an economic moat. Even better, it is widening.

Pricing power

Netflix said it would raise prices in the US in the fourth quarter, from $13 a month to $14 a month for its standard subscription. With that move, Netflix is now significantly more expensive than all of its competitors except HBOMax.

| Service | Owner | Standard Price |

|---|---|---|

| Netflix | Netflix Inc | $14/month |

| HBOMax | AT&T Inc (NYSE: T) | $15/month |

| Disney+ | Walt Disney Co (NYSE: DIS) | $8/month |

| Hulu | Disney | $5.99/month with ads, $11.99/month without |

| ESPN+ | Disney | $5.99/month |

| Amazon Prime | Amazon.com Inc (NASDAQ: AMZN) | $119/year with Prime |

| Peacock | Comcast Corporation (NASDAQ: CMCSA) | Several tiers ranging from free to $10/month |

| Discovery+ | Discovery Communications Inc (NASDAQ: DISCA) | $4.99/month with ads, $6.99/month without |

| Paramout+ | Viacom CBS Corporation (NASDAQ: VIAC) | Pricing yet to be announced |

| Apple TV+ | Apple Inc (NASDAQ: AAPL) | $4.99/month |

Data source: Company websites. Table: Author's own.

As you can see, most competing services are just about half the price of Netflix, and the only one in Netflix's range is HBOMax, though ad-free Hulu comes close. That's because, like Netflix, HBOMax has also earned pricing power as HBO has built a powerful brand in premium television over the last 40 years, and the network regularly brings home the most Emmy awards among networks. Netflix has managed to do something similar over its shorter history as its aggressive content spending strategy and efforts to offer something for everyone has paid off.

Asked about pricing power in the recent earnings call, COO Greg Peters said, "We do think we're an incredible entertainment value, and we want to remain incredible entertainment value." He also explained how the company thinks about price hikes, saying: "OK, we've added more value in the service. Now it's the right time to go back to those members and ask them to pay a little bit more so that we can reinvest it and keep adding it."

Netflix prices its service to optimize its content spend, and that strategy and the quality of its content has allowed it to charge more than its peers, giving it a competitive advantage. It's worth noting also that Netflix as the streaming pioneer has a much larger subscriber base than any of its rivals, giving it another advantage as it can allocate its content spend across more members.

Increasing profitability

Cash burn has long been a problem for Netflix, but the company just told investors that it was very close to being sustainably free cash flow positive, forecasting break-even free cash flow for 2021.

Though cash flow has long been a challenge for the company as the nature of its business demands high upfront costs, on a generally accepted accounting principles (GAAP) basis, Netflix's profitability has significantly expanded in recent years. The company posted an operating margin of 18% in 2020 and expects to deliver a 20% operating margin this year. From there, it gets better as management projects an improvement of three percentage points each year going forward, giving the company a margin of 29% by 2024.

That along with its pricing power also indicates an economic moat in streaming. The debutantes are still trying to figure out a way to build out audience and generate a profit. Netflix, with the help of a long first-mover advantage, has been there for a while, and is pressing its foot on the gas pedal at will.

In addition to those strengths, the company's local content focus and global strategy also separates it from the streaming wannabes as it already has a large library of original foreign language content that drives international growth.

Video entertainment is a huge industry and it won't be monopolized. There's room for more than one winner in streaming, especially as the cable ecosystem continues to weaken, but Netflix remains the leader, setting the pace in the industry. Its competitive advantages are clear.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.