This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

When considering iconic global brands to invest in, Nike (NYSE: NKE) and lululemon athletica (NASDAQ: LULU) are certainly two of the first that come to mind. The organizations generated bountiful success for shareholders over the years and are well set up to continue doing so.

Which is the better investment? Upon examination, it is abundantly clear that both are fantastic options. Here's why:

Nike's promising transition

In Nike's most recent quarter, sales grew by 9% with earnings growing 11% -- both year over year. On the surface, this growth seems somewhat modest. When considering many of Nike's wholesale partners (department stores) are operating under capacity restrictions or closed altogether, this growth becomes much more impressive.

Nike's digital sales grew by 84% year over year, powered by triple-digit growth in North America. This outsized expansion more than offset the pain Nike experienced from restrictions on wholesalers and its own brick-and-mortar stores.

What does this successful pivot to digital mean?

In a normalized business environment, the company earns a roughly 10% higher gross margin on digital sales versus sales transacted via wholesale. If any of this shift has staying power, it should therefore result in meaningful profit gains as the world slowly goes back to normal.

While there is no guarantee this will be the case, the company is confident it can maintain its digital momentum. While Nike today earns roughly 30% of its total revenues through digital channels, CEO John Donahoe expects that number to approach 50% in the coming years. If this forecast turns out to be accurate, it should be a very positive trend for investors.

Donahoe has executive experience with three successful technology companies (ServiceNow, eBay, and PayPal Holdings), offering investors good reasons to think he can continue executing a digital transformation at the helm of Nike.

Lululemon is thriving

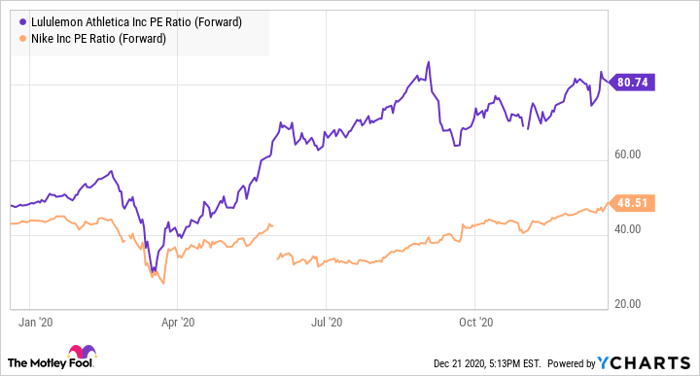

Lululemon is more expensive than Nike on a price-to-earnings basis, and for good reason. In its most recent quarter, the company grew sales by 22% and profit by nearly 15%; this was despite similar pandemic-related retail restrictions that hurt Nike's operations. CFO Meghan Frank directly attributed company growth to increased traffic in Lululemon's digital operations.

LULU PE Ratio (Forward) data by YCharts

For context, the clothing company's direct sales (which include digital sales) now make up 42.8% of total revenues vs. 26.9% just last year. Clearly, Lululemon's focus has shifted rapidly due to COVID-19, and it's paying off.

While some companies are struggling to stay afloat and maintain shareholder returns amid COVID-19, Lululemon managed to initiate a share buyback program of up to $500 million. This does represent roughly 1% of the current market cap, but is a great sign regardless.

Beyond finding success in e-commerce, Lululemon officially expanded into in-home fitness with its acquisition of MIRROR for $500 million. MIRROR offers group and one-on-one floor workouts from the home and plans to broaden its offerings into things like meditation with Lulu's resources.

Lululemon prides itself on offering its fans compelling omni-channel experiences. This purchase allows it to broaden those offerings by adding connected fitness to the mix. With direct competitors like Peloton Interactive trading at 460 times forward earnings (nearly five times more expensive than Lululemon), any success realized with MIRROR offers Lululemon and its shareholders another promising leg of potential returns.

Both are great options

While investing is sometimes a process of choosing one comparable company over another, I do not think you need to do so in this case. Both Nike and Lululemon are performing exceptionally well and are poised to continue doing so for years to come.

Investors can feel confident going with either company -- neither will be going out of style anytime soon.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.