This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

The coronavirus pandemic is causing disruptions in Coca-Cola's (NYSE: KO) operations, without a doubt. Local governments have asked many restaurants and entertainment venues to either shut their doors completely or operate at significantly reduced capacity. That's hurting sales because those are places where people consume many of Coca-Cola's drinks.

Still, when investing in a company, it is best to look at the long term. With positive developments on a coronavirus vaccine, it appears that there will be a return to normalcy sometime after the summer of 2021. Let's look at the company's prospects and determine if it's a good time to buy the stock.

Prospects

Sales for Coca-Cola are struggling to recover as people worldwide are facing a recent surge of coronavirus cases. Still, CEO James Quincey, in the company's third-quarter earnings release, said: "While many challenges still lie ahead, our progress in the quarter gives me confidence we are on the right path."

Indeed, there are challenges. Coca-Cola's year-to-date cash flow from operations is down 20% from the year before.

Over the longer run, the company faces a headwind from people shifting away from sugary beverages. Moreover, the COVID-19 pandemic may leave some lingering long-term effects that will be negative for Coca-Cola. For instance, government stay-at-home orders may cause many restaurants to go out of business, which would hurt Coca-Cola consumption.

That being said, Coca-Cola is a proven company with a decades-long history of quenching customers' thirst for tasty beverages. When the pandemic fades away, and people are comfortable leaving their homes again, consumption of the company's beverages will increase from current levels.

Coca-Cola is a leading player in the non-alcoholic drinks market, which is forecast to have a compounded annual growth rate of 6.8% over the next five years.

Coca-Cola is not going to be growing revenue by double digits for any meaningful period of time. However, if it can grow sales in the middle to low single digits, that's enough for shareholders to have confidence in the company's recovery.

Valuations and profit margins

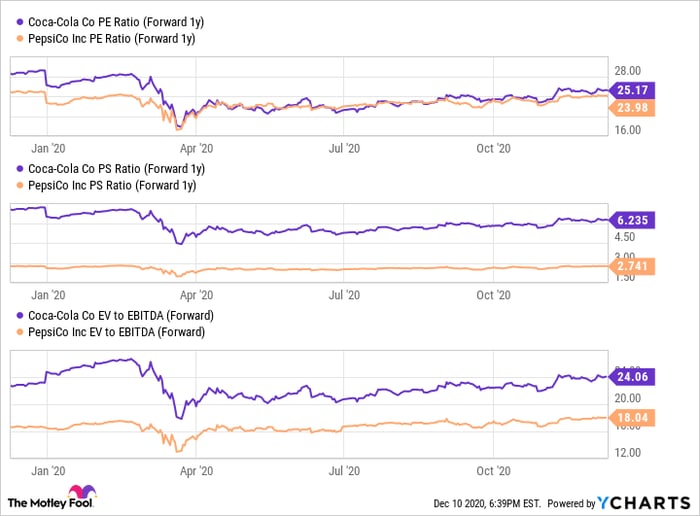

PE = price-to-earnings, PS = price-to-sales, EV = enterprise value, EBITDA = earnings before interest, taxes, depreciation, and amortization. Data source: YCharts.

Coca-Cola is priced at a premium compared to its primary competitor PepsiCo (NASDAQ: PEP)(see chart above). However, that premium has narrowed since the start of the year, as PepsiCo's snack segment has helped it fare better during the pandemic. Moreover, that premium may be justified if you account for Coca-Cola's better operating performance.

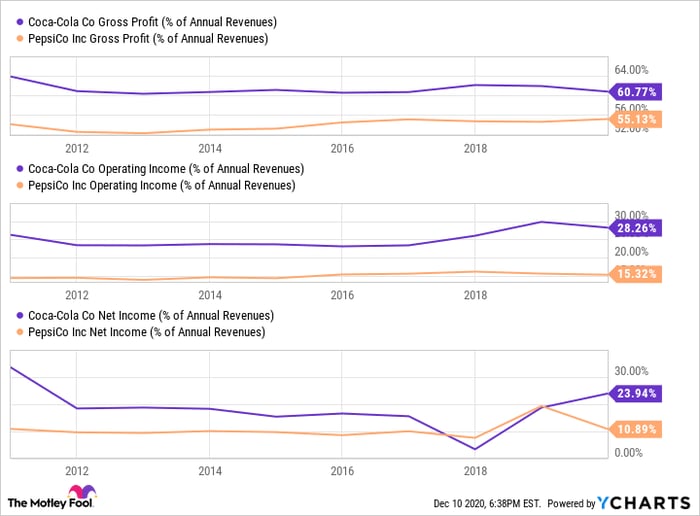

If you compare Coca-Cola to PepsiCo in terms of profit margins, Coca-Cola is clearly the winner (see chart below). This is especially true for operating profit margin. Admittedly, when both companies complete their fiscal year 2020, PepsiCo will likely narrow the differences. However, that might reverse when the pandemic has faded away. Coca-Cola generates more of its revenue from people consuming its products away from home than PepsiCo, and subsequently is more negatively affected by the pandemic.

Data source: YCharts.

The verdict

Coca-Cola is a long-running business success story, making shareholders richer while delighting consumers with tasty drinks for decades. The COVID-19 disease is creating difficulties that are slowing down sales in the near term. However, with vaccines against the virus rolling out in the US and other parts of the world, it could see operations return to normalcy by the end of 2022.

Meanwhile, the disruptions allow you to buy a superior consumer staples stock at a relatively small price-to-earnings (P/E) ratio premium over its competitor. Interested investors can feel good about starting a position in Coca Cola at these levels.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.