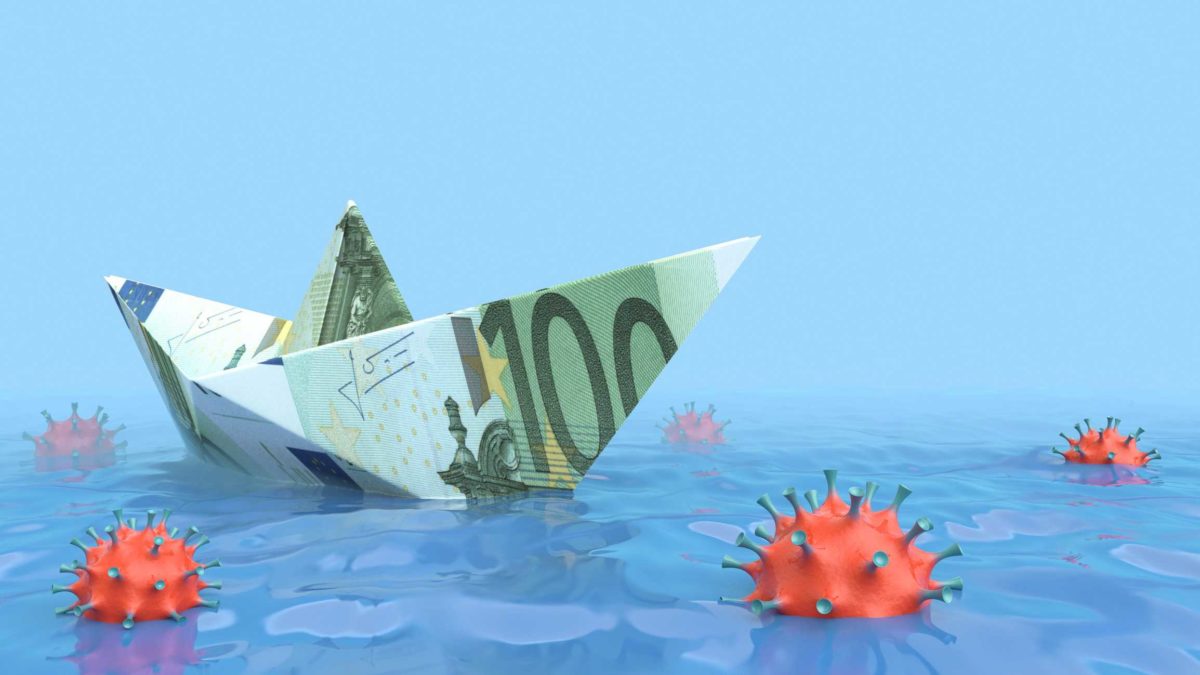

The COVID-19 pandemic first struck in Wuhan, China, sending the city of 11 million people, the wider Hubei region and much of the nation into strict lockdown.

The extreme mitigation measures China immediately took placed the nation in the enviable position as one of the few to have contained the deadly virus.

But with today's reports of renewed outbreaks, China again faces the prospects of an unchecked coronavirus spreading amongst its massive population.

What did China report?

China has reported 181 new cases of COVID-19 in its northwest Xinjiang region. Of those, 161 are people who do not display any symptoms of the disease. The government reported 20 new confirmed cases of people showing symptoms, as Chinese policy doesn't count those with asymptomatic infections as confirmed cases.

Massive testing of some 4.8 million people is under way following what are the first new local infections since 14 October.

Why did the Aussie dollar slip on the news and what to expect from ASX shares?

The relative strength of the Australian dollar is based on more factors than we can list in this article.

But one prime driver that's been keeping the Aussie at a relatively strong level is the high price or iron ore, Australia's number one export earner. China, Australia's number one purchaser of iron ore, uses it to make steel to fuel its massive infrastructure and building projects.

China's voracious appetite for iron ore has been a key driver in keeping the price of the metal far higher than most analysts had forecast, currently at US$121 per tonne.

If the coronavirus manages to get ahead of Chinese authorities, it could see much of the Middle Kingdom's factories shuttered again. If that happens it could quickly see the price of iron ore, and the Australian dollar, fall hard.

Remember, iron ore was trading for $81 per tonne in February. Not long after the Aussie dollar was trading for as little as 52 US cents in mid-March.

On today's news the Australian dollar slid 0.3% to 71.18 US cents.

Meanwhile, the S&P/ASX 200 Index (ASX: XJO) looks to have reacted negatively to the news as well. The ASX 200 was down 0.3% around midday but has since rallied slightly.

Iron ore giant BHP Group Ltd's (ASX: BHP) share price is down 0.6% in that same time.