What kinds of historical returns does the S&P/ASX 200 Index (ASX: XJO) offer?

We Fools routinely implore our readers to consider investing in ASX 200 shares. The sharemarket has historically been one of the greatest wealth creation engines you could have put your money in. But many would-be investors still worry about investing in shares – anxious about the inherent volatility that walks hand-in-hand with share market wealth creation. While it's true that ASX 200 shares have their bad years (some dramatically bad), the real story here is that, most years, shares go up, enriching those who own them. And even in the market's bad years, there is still the comfort of receiving dividends from many stocks.

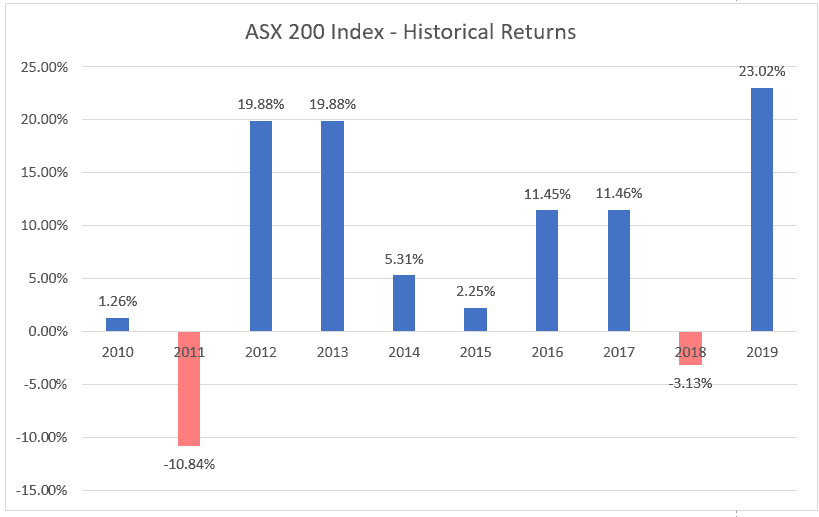

But enough preaching, I'll put my money where my mouth is and look at 10 years of historical returns for the ASX 200 index.

10 years of ASX 200 historical returns

Here are the returns for the S&P/ASX 200 Index from 2010 to 2019, courtesy of S&P Global. These numbers assume the reinvestment of all dividends, but don't include the value of the franking credits that often also come with those dividends.

| Year | ASX 200 Return |

| 2010 | 1.26% |

| 2011 | (-10.84%) |

| 2012 | 19.88% |

| 2013 | 19.88% |

| 2014 | 5.31% |

| 2015 | 2.25% |

| 2016 | 11.45% |

| 2017 | 11.46% |

| 2018 | (-3.13%) |

| 2019 | 23.02% |

Here's a graph showing this data for some extra visualisation:

And here's what these numbers look like if they're annualised:

4.5% per annum (pa) over the past 3 years, 7% pa over the past 5 years, and 6.61% pa over the past 10 years.

For some additional context, the ASX 200 is currently down 7.47% so far in 2020 (year to date).

10 years of returns, 1 reason to invest

Looking at this data, one thing is abundantly clear: ASX 200 shares go up far more often than they go down. Over these 10 years, just 2 delivered negative returns. And in 5 out of 10 years, the annual return for the ASX 200 was more than 10%. In fact, 3 out of 10 years gave investors a near 20% return.

I like those odds.

Of course, critics might point out that this periodical data is bookended by 2 major share market crashes which aren't reflected in these numbers: the global financial crisis of 2008-09, and of course the 2020 March/April coronavirus-induced share market crash. But the reality is that the ASX 200 has never failed, in history, to break its previous all-time high following a market crash. Yes, the ASX 200 is a long way today from its February all-time high of 7,161 points. But history tells us that this will happen again, it's just a question of when.

So, now that you've seen 10 years of ASX 200 historical returns, I hope you're feeling as inspired as ever to invest. And remember, these returns just reflect the ASX 200 index. You can pretty much match this index if you invest in an index fund like the iShares Core S&P/ASX 200 ETF (ASX: IOZ). Or you can try beating these returns by creating your own share portfolio yourself.