Many experts tell Australian retail investors to look beyond the ASX for diversification.

They say the Australian market is too small and dominated by the big banks and mining companies.

Now a simple graph easily demonstrates just how small a pond the ASX is.

Atlassian Corporation PLC (NASDAQ: TEAM) is Australia's largest technology company. But it chose to list on the NASDAQ, rather than the ASX.

The theory is that there is much more investor money available in the US.

Tech shares on the ASX haven't done badly this year. The S&P/ASX All Technology Index (ASX: XTX) has almost doubled since March.

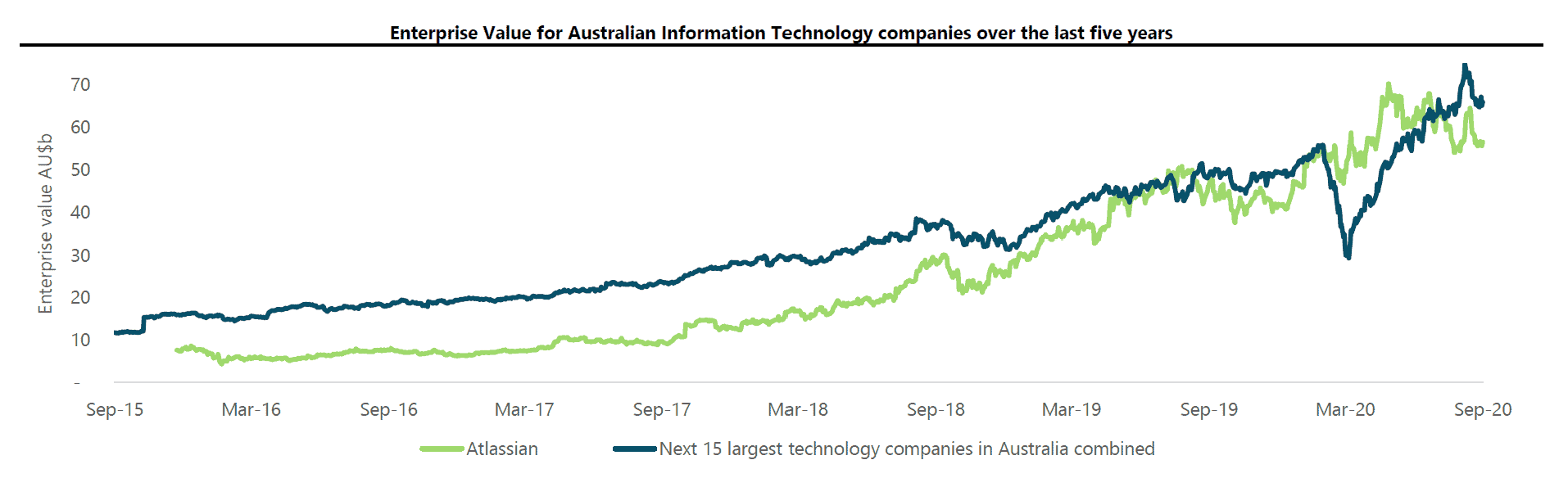

But this graph, put together by Clare Capital, shows how the top 15 ASX tech companies combined are only just bigger than Atlassian by itself:

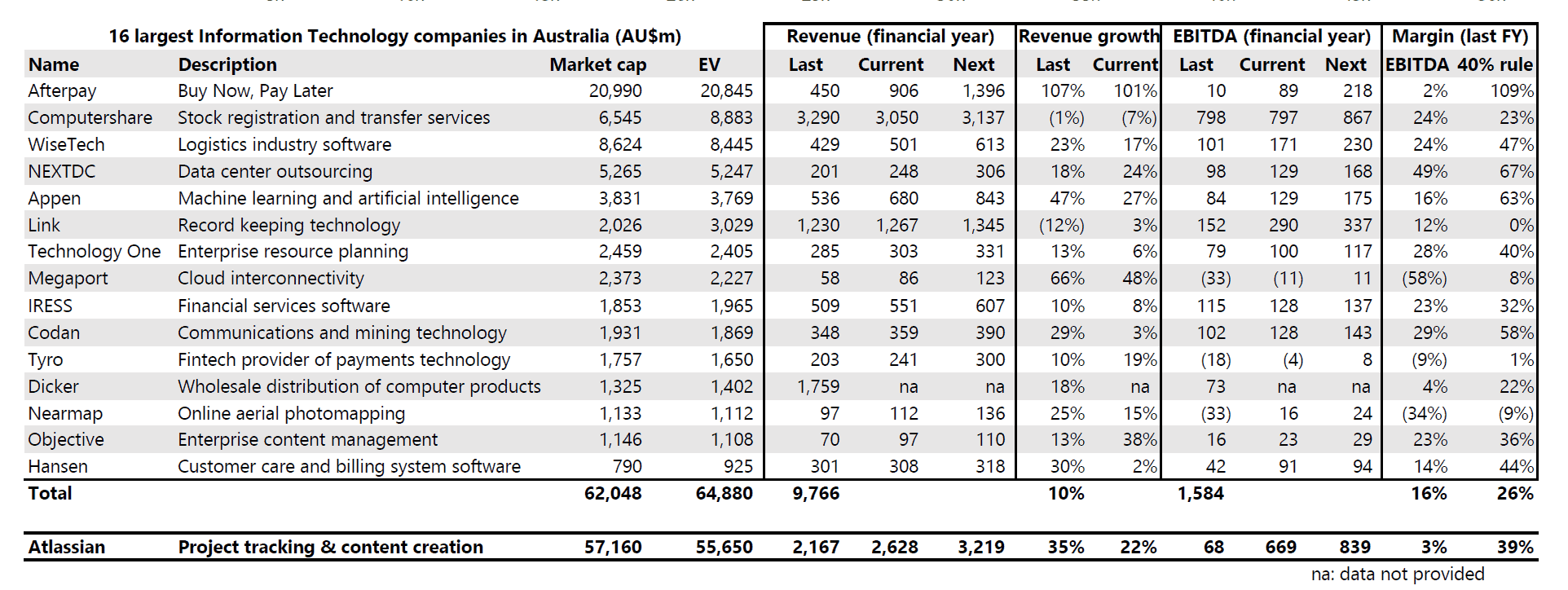

"We think that Nasdaq-listed Australian software company Atlassian is an incredible business," said Clare Capital managing partner Mark Clare.

"Atlassian today has an $57bn market cap, while the 15 largest ASX technology companies have an $62bn combined market cap."

Clare Capital does point out that it used the Capital IQ definition of "information technology" to produce the comparison. Other analysts may disagree with that definition.

But the chart makes the point how much of a monster Atlassian is, and why it swims around in the big pond in the US.

And how the most successful tech companies in the ASX still have a long way to go before they reach the scale of NASDAQ players.

Clare said the numbers were a tribute to Australia's tech sector.

"Here in New Zealand we are proud of the local technology market. These numbers do, however, show the growing scale of what is being achieved in Australia," he said.

"Respect for the value growth that has been achieved."

Atlassian produces software development and project management tools. University mates Mike Cannon-Brookes and Scott Farquhar founded the Sydney company in 2002.

The company listed on the NASDAQ in December 2015, and its co-founders came 5th and 6th on the 2019 Australian Financial Review (AFR) Rich List.