This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

It's been a while since e-commerce and cloud-computing giant Amazon.com, Inc (NASDAQ: AMZN) split its stock. We're talking about the late 1990s when Amazon was a relatively small company with huge dreams.

Things are different now. A single Amazon share costs more than $3,150 today, and the market cap stands at an enormous $1.58 trillion.

Other high-priced market darlings have been announcing stock splits recently. Apple (NASDAQ: AAPL) has scheduled a 4-for-1 split at the end of August. That move will drop Apple's share price from roughly $450 to approximately $113 per stub, assuming that the stock doesn't make any sudden moves over the next three weeks. Tesla (NASDAQ: TSLA) will run a 5-for-1 split of its own on August 31, dropping the single-stock price tag from $1,550 to approximately $310.

I wouldn't be surprised to see a stock split from Amazon, too. Here's why.

Amazon's split history

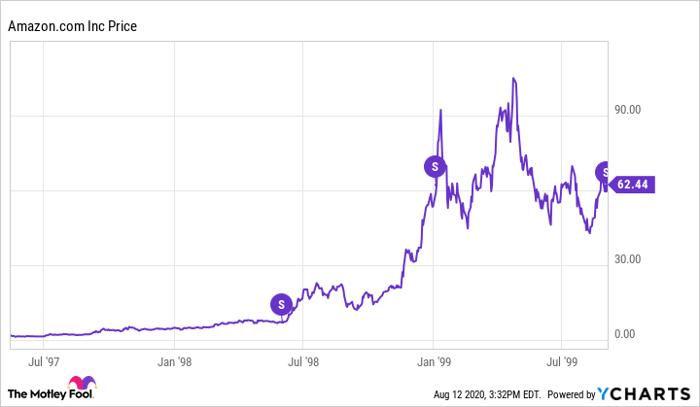

Amazon closed its first day on the public market at a split-adjusted $23.50 per share. Just 13 months later, share prices had grown 270% higher, and Amazon ran its first 2-for-1 split. The next move followed in January of 1999 after an enormous 755% gain in seven months. This time, Amazon issued two new shares for every original stub in an investor's possession, which made it a 3-for-1 split.

Finally, the last 2-for-1 increase followed in September of 1999. There was no crazy price gain to explain this particular accounting move, since the stock had actually dropped 4% lower this time. At this point, each original Amazon share had been transformed into 12 lower-priced tickets.

Amazon's split-adjusted price was roughly $86 per share before the first split, $355 per share on the second occasion, and $119 per share the third time. If the company isn't thinking about another split right now, I don't know if it ever will.

What's the big idea?

Stock splits are a purely mathematical exercise that divides up ownership of the company into a larger number of lower-priced shares. It's like cutting your pizza into 12 slices instead of six. Nobody gained or lost anything here, but you can distribute the slices with more granular precision.

A $3,000 stock can be difficult to afford for an ordinary investor with a limited investment budget. The price tag alone can keep many investors away from high-quality stocks. This is becoming less of an issue these days because some stockbrokers allow you to buy fractional shares of high-priced stocks, and exchange-traded funds (EFT) offer another method for dodging a high single-stub purchase price. Still, you can't match the simplicity of directly buying full shares of the company you actually want to own. Some people may not even be aware of the more complicated options.

From Amazon's point of view, the high stock price might keep the company out of price-weighted indexes such as the Dow Jones Industrial Average . Apple is currently the highest-priced ticker in that closely watched index, and the lofty price gives Cupertino exaggerated power over the Dow's value. A 10% change in Apple's stock would move the Dow 1.1% higher or lower, assuming that the other 29 members don't change at all. After Apple's split, the same 10% move would nudge the Dow in the same direction by just 0.4%.

For this reason, the Dow rarely invites stocks with very high share prices. Tesla CEO Elon Musk has publicly floated the idea of adding the electric car maker to the Dow now that its share prices won't stand in the way. Amazon CEO Jeff Bezos would have to perform a fairly extreme stock split before presenting a similar case. Amazon would still carry land among the five highest share prices on the Dow after a 15-for-1 split.

If Bezos has any interest in joining the Dow, I would expect an ostentatious stock split very soon. A less dramatic 3-for-1 or 5-for-1 split would also be helpful to small investors. Tesla's and Apple's very recent announcements could be the last straw, because Jeff Bezos certainly has a flair for the dramatic.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.