2020 has been a good year for investors in ASX gold shares.

The Saracen Mineral Holdings Limited (ASX: SAR) share price has rocketed 83.1% higher this year. Similarly, shares in St Barbara Ltd (ASX: SBM) and Northern Star Resources Ltd (ASX: NST) are 26.0% and 39.8% higher, respectively.

That's largely been driven by gold prices rocketing to new record highs in 2020. Market volatility and economic uncertainty have created a surge in demand for the precious metal.

Many investors would think this means the buying opportunity and bull market are over. However, one leading fund manager says it's just beginning.

Why one leading fundie sees an ASX gold share boom

That fundie is Paragon Funds Management Chief Investment Officer, John Deniz.

In a market update yesterday, Mr Deniz pointed to 6 key factors supporting a further ASX gold share boom. These were:

- Low US 10-year bond yields

- Low US real rates

- A ballooning US budget deficit

- Strong US fiscal and monetary stimulus

- Deep global liquidity and money supply

- A weakening US dollar

Mr Deniz says that all of these signs point to a further increase in demand for gold. For context, gold is often seen as a 'safe haven' asset with good inflation hedging properties.

But rather than stick to the qualitative factors, Mr Deniz backed up the ASX gold share bull case with some numbers.

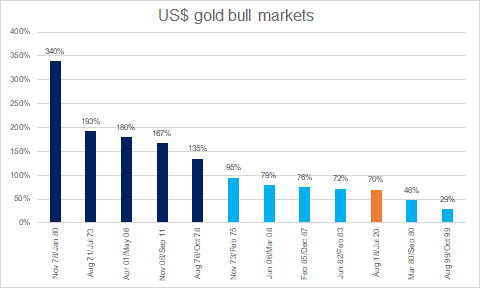

In particular, he highlighted some of the biggest gold bull cycles in recent years. Notably, the most significant one occurred when US real interest rates went negative and gold exchange-traded funds (ETFs) saw strong inflows (shown in dark blue below).

How should I position my portfolio?

Before you go all-in on ASX gold shares, it's important to take a step back. While this paints a convincing picture, there's no such thing as a free lunch in investing.

There is still the risk that we'll see a strong economic bounce back in 2020. That could ease the demand for gold and mean the S&P/ASX 200 Index (ASX: XJO) surges higher.

Given the strong gains in ASX gold shares already this year, much of this growth may also have already been priced in.